Outlook

The AUD is testing multi-year highs this week as risk appetite improves and domestic rate expectations remain hawkish. The currency sits around US$0.7072, benefiting from sticky Australian inflation and softer US data that have bolstered the case for tighter policy in Australia while weighing on the US dollar. Strategists at National Australia Bank expect the Aussie to hover near US72¢ by December, with potential for US75¢ in 2026 if global conditions stay supportive. The rally follows a February 2026 RBA rate hike to 3.85% and a December CPI print at 3.8%, underscoring a hawkish tilt at home. Gains are also supported by a roughly 5% stronger trade-weighted index since late-2025, and ongoing demand for Australian commodities amid policy easing in China. A sustained risk-on environment and firm commodity prices could push the AUD higher toward the US72–US75¢ zone; a shift to risk-off or a stronger USD could cap upside.

Key drivers

- Sticky inflation in Australia reinforces the case for further RBA tightening.

- Softer US data has weakened the US dollar, providing the AUD with additional lift.

- RBA’s February 2026 rate hike (to 3.85%) supports a higher-for-longer stance.

- Trade-weighted index appreciation and improved demand for Australian commodities bolster the currency.

- China’s policy stance and related commodity demand remain a key external factor.

Range

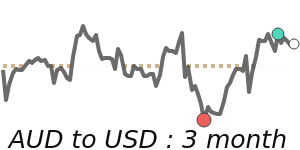

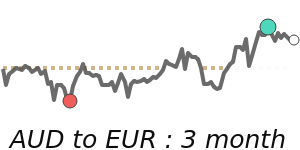

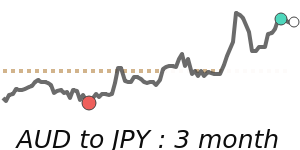

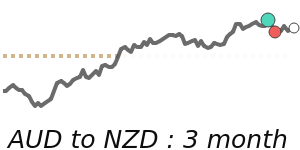

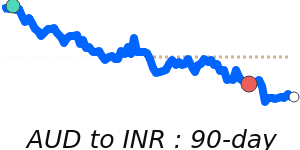

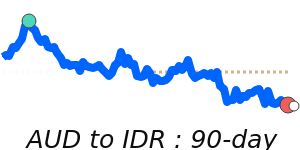

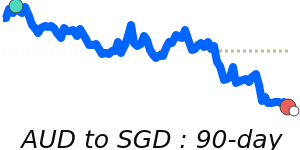

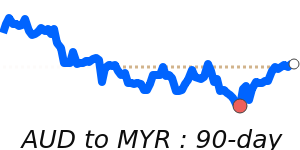

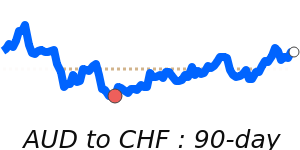

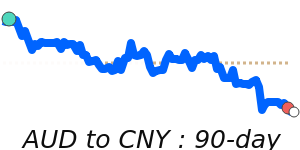

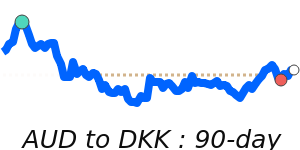

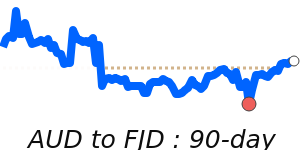

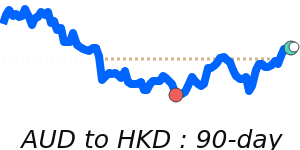

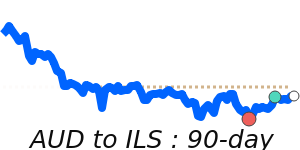

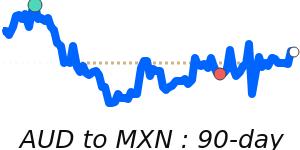

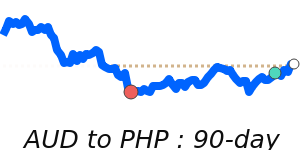

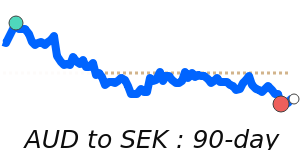

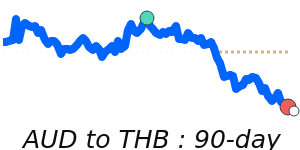

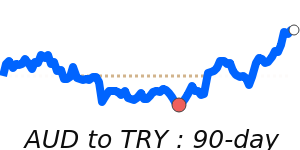

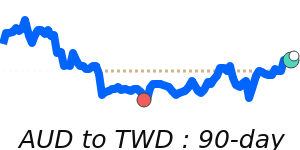

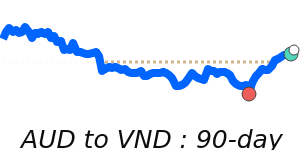

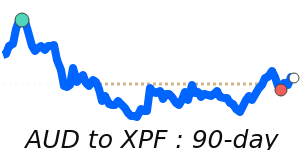

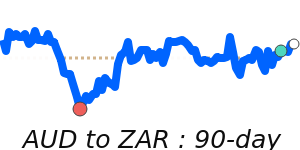

Current levels show the AUD strengthening across major pairs. AUDUSD sits at 0.7072, about 5.1% above its 3-month average of 0.6728, after trading in a roughly 10.6% range from 0.6444 to 0.7125. In EUR terms, AUDEUR is 0.5958, about 3.8% above its 3-month average of 0.5742, with a 7.4% trading range from 0.5591 to 0.6002. Against GBP, AUDGBP is 0.5181, about 3.5% above its 3-month average of 0.5008, and has moved within a 6.5% range from 0.4913 to 0.5231. AUDJPY is near 108.0, about 2.9% above its 3-month average of 105, having traded in a fairly volatile 9.7% range from 100.8 to 110.6.

What could change it

- A renewed rise in US rates or stronger US data could strengthen the dollar and temper AUD gains.

- A further RBA hike or hotter domestic inflation data could push the AUD higher toward the US72–US75¢ area.

- A material drop in commodity prices or a slowdown in China demand could weigh on the AUD.

- Increased risk-off sentiment or geopolitical tensions could shift flows away from risk currencies toward the USD or JPY.