Outlook

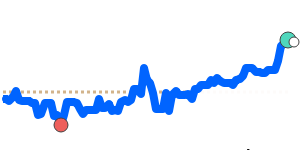

Malaysia's economy is showing resilience, with Q3 2025 GDP up 5.2% and Foreign Direct Investment rising in data centers and semiconductor manufacturing. Bank Negara Malaysia kept policy rates at 2.75%, helping narrow the interest-rate gap with the U.S.; fiscal reforms are improving discipline. Together, these factors are contributing to a firmer MYR in early 2026, with higher oil prices providing additional support to export earnings.

Key drivers

• Strong economic performance supported by domestic demand, exports, and mining/construction activity.

• Increased foreign direct investment in tech infrastructure boosting investor confidence.

• Narrowing interest-rate differentials as the U.S. slows hikes and Malaysia holds at 2.75%.

• Fiscal consolidation efforts, including subsidy reforms, improving fiscal discipline.

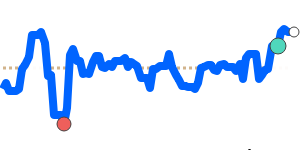

• Oil price strength boosting Malaysia’s terms of trade, with Brent Crude OIL/USD at 71.03, about 9.9% above its 3-month average and a wide 21.5% trading range (59.04–71.76).

Range

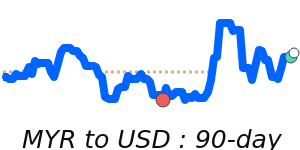

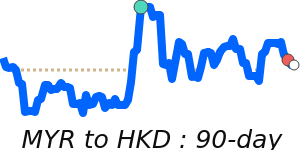

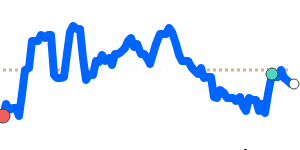

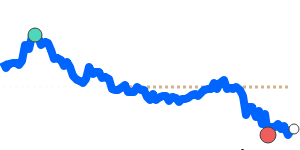

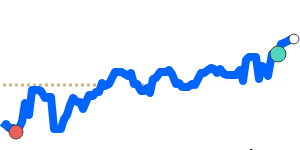

• MYR/USD at 0.2568 (3.3% above its 3-month average of 0.2486), range 0.2418–0.2570.

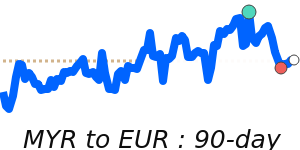

• MYR/EUR at 0.2181 (3.0% above its 3-month average of 0.2117), range 0.2072–0.2181.

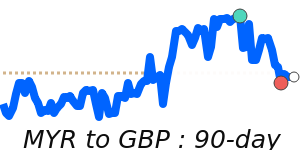

• MYR/GBP at 0.1903 (3.2% above its 3-month average of 0.1844), range 0.1813–0.1905.

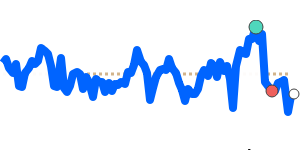

• MYR/JPY at 40.05 (3.3% above its 3-month average of 38.78), range 37.56–40.05.

What could change it

• A shift higher in U.S. rates or a renewed widening of the U.S.–Malaysia rate gap could pressure the MYR.

• Sustained stronger FDI and continued fiscal reforms could extend the currency’s strength.

• Oil-price volatility could alter Malaysia’s export dynamics and terms of trade.

• Unexpected domestic policy changes or fiscal authorities easing subsidy reforms could alter the trajectory.