Outlook

The rand is seen staying supported in the near term on a clearer fiscal path, a rating upgrade, and a credible inflation framework, with energy sector gains supporting growth. External factors such as a firmer dollar or commodity shifts could cap gains, while ongoing fiscal momentum and energy reliability support gains through the quarter.

Key drivers

- Fiscal consolidation targets improve debt dynamics and investor confidence

- S&P upgrade to BB in late 2025 enhances foreign inflows

- SARB’s 3% inflation target with 1% tolerance anchors expectations

- Energy stability and higher freight activity lift growth prospects

Range

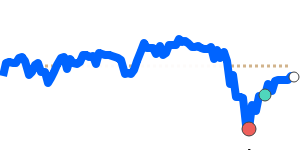

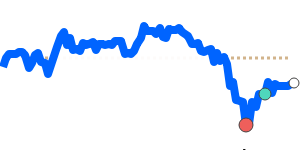

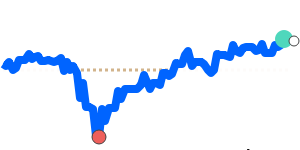

ZAR/USD: near 0.0600, at 60-day low; 60-day range roughly 0.0586–0.0635

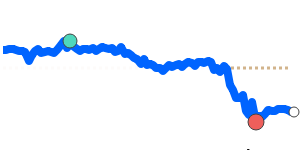

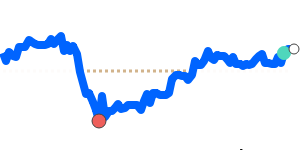

ZAR/EUR: near 0.0517; range roughly 0.0504–0.0534

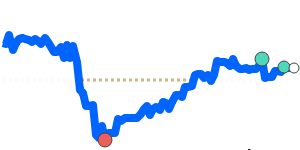

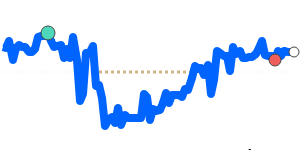

ZAR/GBP: near 0.04495; range roughly 0.0440–0.0466

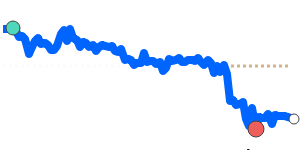

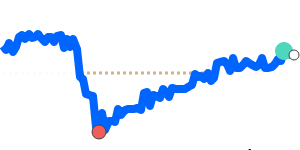

ZAR/JPY: near 9.46; range roughly 9.152–9.858

What could change it

- Further fiscal consolidation steps or deviations

- Any downgrade or upgrade by rating agencies

- SARB policy surprises or inflation shifts

- Energy supply stability or infrastructure bottlenecks

- Global dollar moves or commodity price shocks