Outlook

The SGD faces a mixed near-term path. Domestic momentum remains supportive—MAS shifted policy to a more accommodative stance in 2025 and Singapore posted robust Q4 2024 growth—but external headwinds from US trade actions and a soft global backdrop lend against a material move higher. With core inflation subdued, MAS is likely to maintain accommodative policy, which can cap upside for the SGD. In the period ahead, SGD moves will hinge on risk sentiment and trade-policy developments as much as on domestic data.

Key drivers

- MAS policy: In January 2025, MAS reduced the slope of its policy band, signaling a shift toward accommodation to support growth amid easing inflation.

- Domestic growth: Singapore expanded 5% in Q4 2024, underscoring resilience and providing SGD support against a weak external backdrop.

- Trade policy: In April 2025, a 10% US tariff on goods from Singapore adds external headwinds for Singapore’s export-driven economy, weighing on SGD under risk-off conditions.

- Inflation: Core inflation was 0.8% YoY in January 2025, keeping monetary policy accommodative and limiting upside for the SGD.

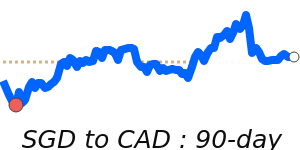

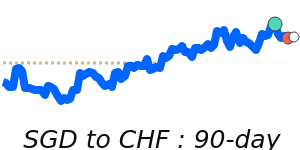

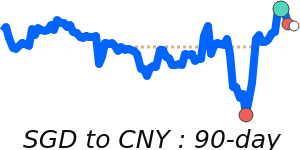

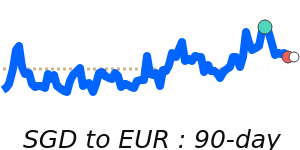

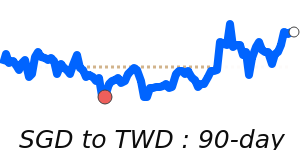

Range

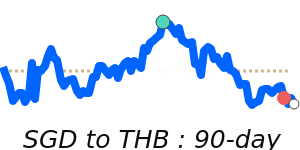

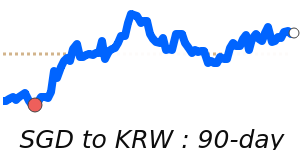

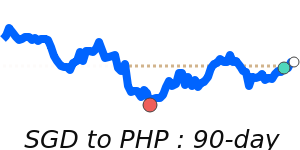

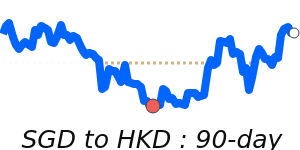

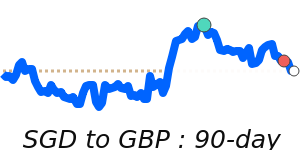

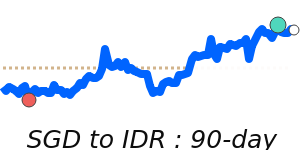

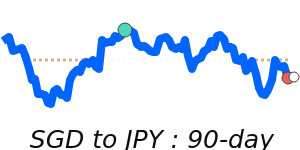

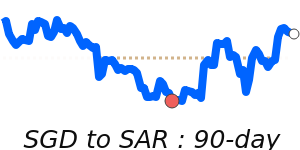

SGD/USD is around 0.7839, near 7-day lows and about 1.0% above its 3-month average of 0.7759, having traded in a very stable 3.8% range from 0.7644 to 0.7934. SGD/EUR at 0.6655 sits just above its 3-month average, with a 1.6% range from 0.6593 to 0.6696. SGD/GBP at 0.5798 sits near 14-day highs, within a 2.3% range from 0.5730 to 0.5863. SGD/JPY at 122.8 is 1.3% above its 3-month average of 121.2, having traded in a 4.9% range from 117.9 to 123.7.

What could change it

- policy stance changes: A shift to more aggressive tightening by MAS could lift the SGD; a renewed easing bias could cap gains.

- trade and growth dynamics: A resolution or escalation of US-Singapore trade tensions, or a sharper global slowdown, could push the SGD lower or higher depending on risk sentiment.

- inflation surprises: An uptick in inflation could push MAS to adjust policy earlier, supporting the SGD; unexpectedly soft inflation could keep the SGD under pressure.

- risk appetite: A shift in global risk sentiment—stronger appetite tends to support the SGD versus the USD, while risk-off tends to weaken it.