How to Choose the Best Money Transfer Provider

A comprehensive guide to choosing the best money transfer provider, covering key factors like fees, speed, exchange rates, and customer support, with comparisons of top providers.

OFX vs Wise: Which Money Transfer Service Is Best For You in 2025

Looking to transfer money internationally? We compare OFX and Wise side by side, covering costs, exchange rates, speed, and features to help you choose the best service for your needs in 2025. Which one is right for you depends largely on how much you’re sending, how often you transfer, and whether you value real-time convenience or personal account management.

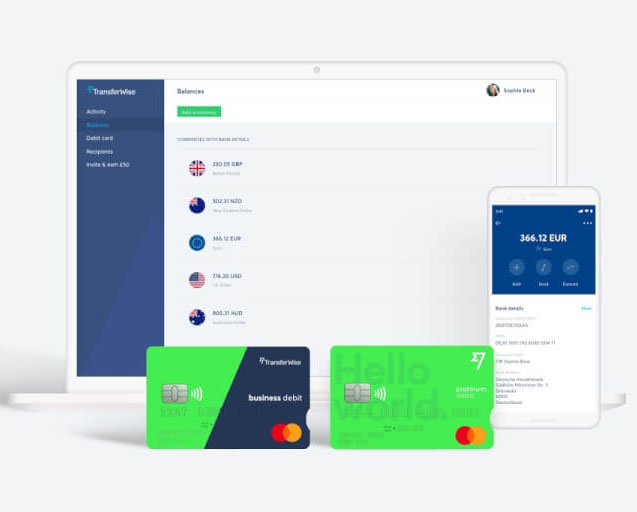

Wise Review: Is It the Best Way to Transfer Money Internationally?

The Wise Account allows users to hold and convert funds in 40 different currencies and send and spend internationally, all at the “real” exchange rate and with exceptionally low service fees. Users can also receive major-currency payments free of charge.

OFX Money Transfer Review: Fees, Rates & Features Explained (2025)

OFX is a reputable international money transfer service that caters to both individuals and businesses, offering a range of features designed to facilitate global transactions.

Dunbridge Financial Review: A Smarter FX Solution for Canadian Businesses

Dunbridge Financial is a Canadian-based international payments provider designed for business. With fast onboarding, competitive exchange rates, and personalized FX support, it’s a digital-first alternative to traditional banks for managing global currencies.

Chase Bank Exchange Rates

Chase Bank provides convenient foreign exchange and international transfers for U.S. customers, but often at a premium. With high wire fees and a 4–6% markup on exchange rates, it’s worth comparing Chase with low-cost providers like [Wise or OFX](/guides/ofx-vs-wise-which-is-best) before sending money abroad.

Should You Use Western Union? Comparing Features, Fees & Speed Globally

Is Western Union still a good way to send money abroad? This review compares Western Union to other international transfer services on cost, speed, and convenience—helping you choose the right option for your needs in 2025.

TorFX Reviewed: A Trusted Money Transfer Option for UK and Australian Users

Looking to send money overseas from the UK or Australia? TorFX provides fee-free transfers, strong exchange rates, and personal service—ideal for large payments like property or relocation. Find out if it’s right for you in 2025.

Wise vs Revolut vs Travelex – Best Travel Money Card Comparison

Looking for the best travel card? We compare Wise, Revolut, and Travelex across key features like FX rates, fees, ATM access, and app tools so you can choose the smartest way to manage your money abroad.

XE Money Transfers - Guide and Review

XE works on razor thin margins for money transfers to more than 100 countries and nearly always guarantees a fantastic deal. Transfers can be booked online and over the phone and most are processed within a single working day.

WorldFirst Foreign Transfers - User Reviews

WorldFirst is a market leader in the international payments space and is consistently ranked among the most reliable and cheapest money transfer handlers for four-figure sums.

American Express - Review of Exchange Rates

Our review of American Express exchange rates & international money transfer services.

WorldFirst World Card

WorldFirst World Card is a virtual Mastercard designed for global businesses, allowing online payments in multiple currencies with no FX fees.

WorldRemit Review

With WorldRemit, send money online 24/7 to 140 destinations at highly competitive exchange rates. Send to bank accounts and mobile money wallets, top up a loved one's mobile phone or send for cash pick-up.

WorldFirst World Account

WorldFirst World Account is a multi-currency business account that allows you to hold, send, and receive funds in over 40 currencies, making it ideal for global businesses and online market-place sellers.

Instarem Money Transfers - User Reviews

Instarem provides fast, safe and cost effective cross border money transfer services for Individuals and businesses from Australia, Hong Kong, India, Malaysia and Singapore to more than 25 countries.

Wise Account

The Wise Account allows users to hold and convert funds in 40 different currencies and send and spend internationally, all at the “real” exchange rate and with exceptionally low service fees. Users can also receive major-currency payments free of charge.