Australian dollar (AUD) Market Update

The Australian dollar (AUD) has experienced notable volatility recently, driven by a mix of geopolitical developments and shifting investor sentiment. Following U.S. President Donald Trump's announcement of a 10% tariff on Australian imports, the AUD initially faced downward pressure. However, optimism surrounding upcoming US-China trade talks provided some respite, allowing the currency to partially regain its footing. Despite these gains, the AUD could not maintain its strength as trading shifted into the European session.

Current market dynamics continue to exert influence over the AUD, particularly in light of a hawkish interest rate decision from the Federal Reserve, which typically dampens the appeal of riskier assets like the Australian dollar. The lack of significant domestic economic data means that broader market trends will likely dictate the currency's performance in the near term. Analysts suggest that an anxious mood among investors may further contribute to a potential softening of the AUD.

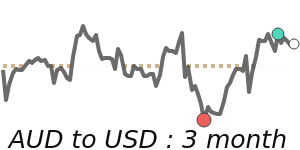

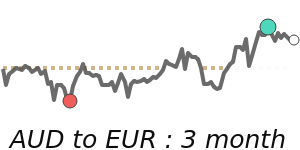

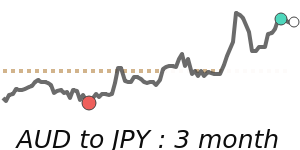

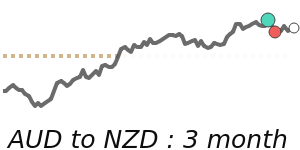

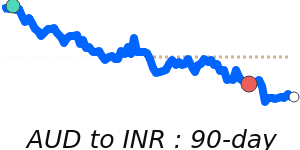

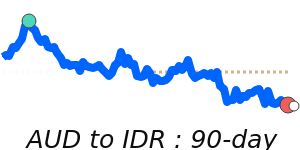

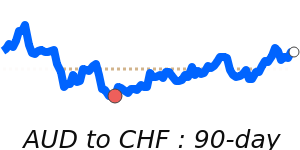

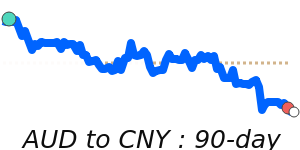

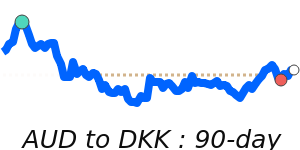

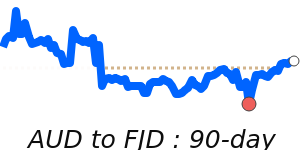

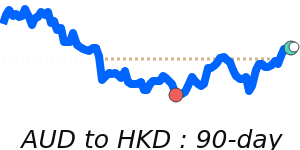

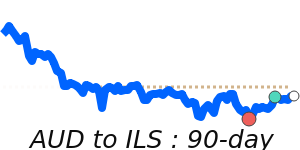

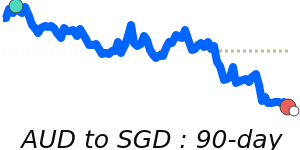

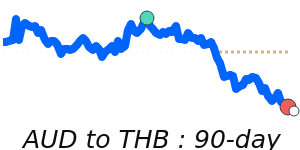

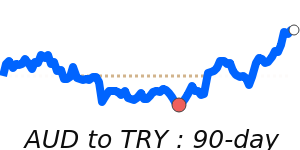

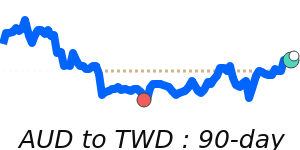

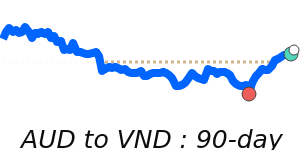

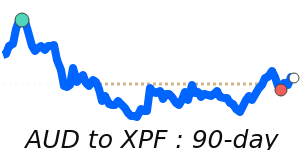

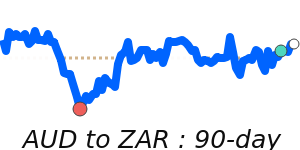

Recent price action reflects the AUD's complex relationship with global economic factors. Against the U.S. dollar, the AUD is trading at 0.6394, which is 1.3% above its three-month average of 0.6314. This pair has experienced a volatile range of 9.0%, oscillating between 0.5957 and 0.6495. In contrast, the AUD to Euro exchange rate stands at 0.5695, 1.7% below its three-month average of 0.5796, having fluctuated in a significant 12.2% range. Similarly, the AUD to GBP rate is at 0.4830, 1.1% below its three-month average, demonstrating an 8.8% range. Meanwhile, the AUD to JPY is currently at 93.31, trading near its three-month average with an 11.4% range.

As a commodity currency, the value of the AUD remains closely linked to the prices of key exports such as iron ore, coal, and natural gas. Strength in these sectors often bolsters the AUD, while declines can lead to depreciation. Ultimately, ongoing developments in global trade policies, shifting interest rate expectations, and economic performance, particularly in relation to China's economy, will be key factors shaping the AUD's trajectory moving forward. Investors should keep an eye on market sentiment and economic indicators as they navigate this volatile landscape.