Danish krone (DKK) Market Update

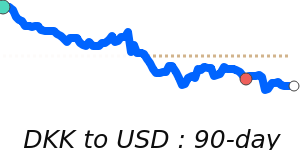

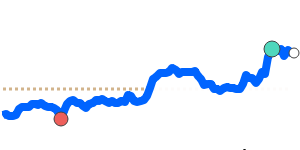

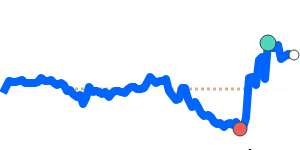

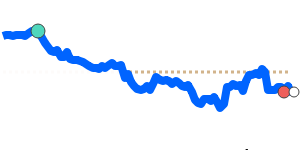

The USD to DKK exchange rate has recently experienced fluctuations, reflecting broader market dynamics and sentiment influenced by U.S. monetary policy and geopolitical events. Currently, the USD is trading at near 14-day highs around 6.6462. However, this rate is approximately 3.0% below its three-month average of 6.8516, amidst a notable volatility range of 11.6% between 6.4849 and 7.2366.

Recent analysis indicates that the U.S. dollar has garnered strength following the Federal Reserve's decision to hold interest rates steady and assess the impacts of tariffs on the economy. This 'wait and see' approach has buoyed the dollar, with expectations that further signals from Fed officials could sustain USD appreciation if they indicate that high rates might persist longer due to inflationary pressures. Analysts suggest that any discussion surrounding potential recession risks could offset gains and place downward pressure on the dollar.

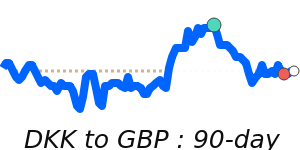

The current interest in U.S. trade agreements, particularly with the U.K., adds another layer to the U.S. dollar's outlook. While these agreements may temporarily bolster the dollar, uncertainties around tariffs, particularly the newly imposed 10% tariffs on UK imports and escalated duties on other nations, might raise concerns about broader economic implications.

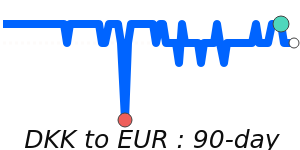

For the Danish kroner (DKK), which is fixed to the Euro, the exchange rate against the USD is largely influenced by movements within the Eurozone and U.S. economic stability. Denmark's fixed exchange rate policy provides substantial stability for its economy but has challenges during times of volatility in other major currencies, limiting the Danish central bank’s flexibility.

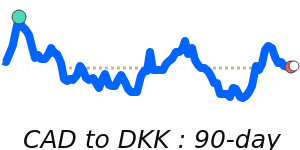

Given the USD's status as a safe-haven currency, its value could strengthen amid further economic uncertainties. However, if the growing discourse about a potential recession materializes, market anxiety may lead to shifts that influence both the USD-DKK exchange rate and broader forex trading landscapes. Economists and market watchers will continue to monitor both Fed statements and global economic indicators closely for future direction.