Mexican peso (MXN) Market Update

The Mexican peso (MXN) has demonstrated notable volatility recently as traders respond to ongoing tensions regarding tariffs imposed by the United States. After President Claudia Sheinbaum's announcement of potential retaliatory measures against the U.S. following the implementation of tariffs by the Trump administration, the peso initially declined. However, optimism grew when U.S. Commerce Secretary Howard Lutnick hinted at possible tariff reductions, leading to a rebound in the currency.

The market appears to reflect a belief that the current 25% tariffs against Mexico may not be a long-term fixture. This sentiment was bolstered when President Trump agreed to delay the tariffs for one month after a discussion with Sheinbaum, during which Mexico committed to deploying 10,000 troops to its border to curb fentanyl trafficking and manage migration. In light of these developments, the peso rallied, leading the charge among risk currencies.

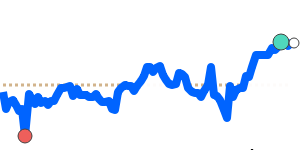

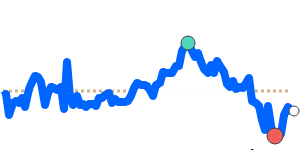

Recent price data underscores the peso's current strength. The MXN to USD exchange rate reached near 90-day highs at 0.051431, representing a 3.5% increase over its three-month average of 0.049696. The volatility observed over this period has seen the pair trade within a relatively stable range of 7.2%, from a low of 0.047972 to a high of 0.051431.

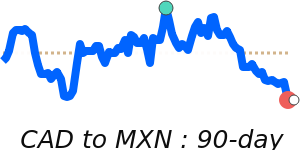

In relation to other currencies, the MXN also performed well against the Euro, achieving 30-day highs at 0.045719, which is marginally above its three-month average, amid a 9.0% range of fluctuation. Similarly, against the British pound, the peso reached 30-day highs near 0.038658, just slightly exceeding its three-month average. against the Japanese yen, the MXN stood at 30-day highs of 7.4768, reflecting a 2.1% increase over its three-month average.

Overall, analysts suggest that the peso’s recent movements indicate a cautious optimism in the market, driven by diplomatic efforts between Mexico and the United States, as well as broader trends in risk appetite. As negotiations unfold, currency users should remain vigilant but may find currently favorable rates for international transactions.