Mexican peso (MXN) Market Update

The Mexican peso (MXN) has recently experienced significant volatility, primarily influenced by the shifting dynamics in US-Mexico trade relations. The instability stemmed from President Claudia Sheinbaum’s announcement of potential retaliatory measures against the United States following new tariffs imposed by the Trump administration. Initially, this uncertainty led to a decline in the peso against the US dollar. However, the currency rebounded as US Commerce Secretary Howard Lutnick indicated that these tariffs may be eased, sparking optimism for negotiations between the two nations.

Analysts note a notable shift in the trade discourse, as President Trump agreed to delay the implementation of the 25% tariffs for one month, a decision made after a conversation with Sheinbaum. In a reciprocal gesture, Mexico has committed to deploying 10,000 troops to the US border to address concerns over fentanyl and migration. This development has led to a rally in riskier currencies, with the peso leading the charge.

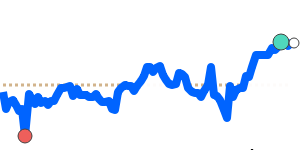

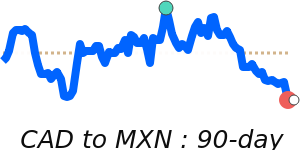

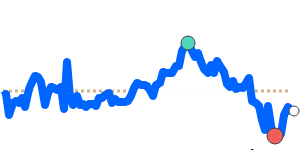

In terms of recent trading metrics, the MXN to USD exchange rate has reached 90-day highs at approximately 0.051434, reflecting a 3.4% increase above its three-month average of 0.049753. This pair has oscillated within a 7.2% range, trading between 0.047972 and 0.051434. Meanwhile, the MXN to EUR stands at 0.045794, which is just 0.6% above its three-month average of 0.045536, revealing a more volatile trading range of 9.0%, between 0.043332 and 0.047252.

Additionally, the strength of the peso against the British pound has reached 30-day highs around 0.038716, slightly up by 0.9% from its three-month average, while maintaining a stable range of 4.6%, from 0.037579 to 0.039298. The MXN to JPY shows a similar trend, trading at 7.5013, which is 2.4% above its three-month average of 7.3282 and within a range from 7.0176 to 7.5209.

Overall, market participants are closely monitoring developments in US-Mexico negotiations, as expectations build that the tariffs will not remain in place long-term. These factors will likely continue to drive volatility in the peso as economic conditions evolve.