U.S. Dollar Index - What is it?

The U.S. Dollar Index is a measure of the value of the United States dollar relative to a basket of six foreign currencies. The Index goes up when the U.S. dollar is stronger compared to other currencies.

For some relative context, the U.S. Dollar Index started in 1973 at the value of 100.000. It has since traded as high as 164.72 in February 1985, and as low as 70.69 in March 2008.

Which currencies are in the U.S. Dollar Index ?

The U.S. Dollar Index is a weighted geometric mean of the US dollar's value relative to following six currencies:

- Euro (EUR), 57.6% weight

- Japanese yen (JPY) 13.6% weight

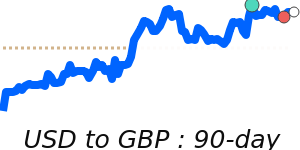

- Pound sterling (GBP), 11.9% weight

- Canadian dollar (CAD), 9.1% weight

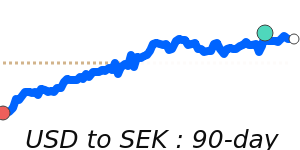

- Swedish krona (SEK), 4.2% weight

- Swiss franc (CHF) 3.6% weight