USD Market Update

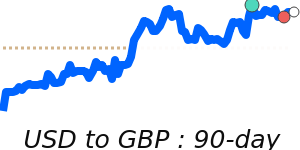

The US dollar remains firm, supported by ongoing geopolitical tensions and recent economic data. With fresh conflict in the Middle East, the USD has gained strength as a safe haven, especially against the euro and the British pound, both of which are trading near their 90-day highs. The USD/EUR has climbed to around 0.8685, well above its recent average, reflecting increased caution among investors. Similarly, USD/GBP has risen to approximately 0.7525, indicating sustained euro and pound gains.

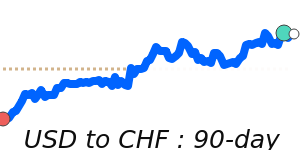

against the yen, the USD reached near 158.7, the highest in a month, driven by the safe-haven demand amid Middle East uncertainties. Meanwhile, the USD has held steady against the Canadian dollar and Swiss franc, trading near their 3-month averages, though the recent geopolitical developments continue to underpin overall USD strength.

Economic updates, including the unexpected loss of 92,000 US jobs last month, have not prevented the dollar from maintaining its upward momentum. Investors are also adjusting expectations for Federal Reserve rate cuts, with a tilt towards fewer cuts this year, further supporting the currency.

Overall, expect the USD to stay supported in the near term, especially if geopolitical tensions intensify.