Foreign Currency Fees for Credit Cards

Avoid the hidden fees and charges when using your credit card abroad. Find out how to save money on your next trip by using a Prepaid Travel Card or ordering your foreign cash online.

Wondering what those extra "International Fees" are on your credit card statement for purchases in Foreign currencies? Most banks and financial institutions charge these sneaky fees for transactions in a foreign currency (as much as 3% of the amount), only a few do not charge a fee for this so it's worth knowing what your card is costing you.

The Credit Card provider will typically charge 1% to 2% from the market mid-rate. Then your bank may also charge an extra 3% on top of this as an "Overseas Transaction Charge". Additionally, there may be an "Overseas ATM" Fee when taking money out of ATMs abroad.

Using your credit card for cash advances is generally not a good idea, at home but least of all abroad. Once you begin using your credit card overseas, withdrawing cash will only escalate the fees. On top of the normal interest rate and lack of interest-free days, you can be imposed a "Cash Advance Fee" $1-$10 / 1%-4% fee (whichever is higher) every time you carry out an overseas cash advance. You will also be charged the standard cash advance rate for your credit card (as well as the international cash advance fee).

If you have a trip planned in the next 6 months or so, it could be worth stocking up and purchasing a portion of the foreign currency now on a Prepaid Foreign Currency Travel Card rather than waiting until you arrive.

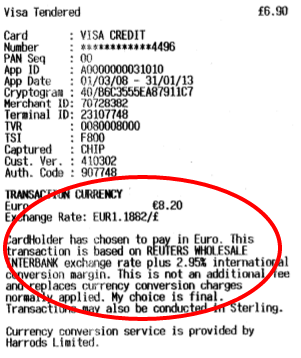

Avoid dynamic currency conversion (DCC)

When paying with a credit card abroad, the retailer may (or may not) give you the option to pay your bill in your own currency, rather than the local one, using dynamic currency conversion.

While this is convenient, as you can get an idea of the value of your purchase, it comes at a price. You’ll be charged a higher exchange rate for dynamic currency conversion, which isn't worth paying.

DCC is simply not worth it for the consumer. Unless you like paying a convenience fee of up to 5% of the total transaction just to know how much you will be billed, you should always decline DCC and ask to be billed in local currency when handing over your card.

The problems don't stop there since many banks still charge a 3% foreign transaction fee (FTF) for purchases made outside of your home country, so when you get home you might discover that the whole DCC experience has cost you 8% extra.

The retailer might automatically use dynamic currency conversion unless you say not to, so it’s best to check your bill carefully before signing anything or entering your PIN. If they have used dynamic currency conversion, ask to be billed in the local currency instead.

American Express currently does not support DCC on its network, so you are safe from DCC if using an American Express card. However, Visa and MasterCard card networks can support DCC, so be vigilant when purchasing abroad with a Visa or MasterCard branded card.

Some merchants will claim that their systems have to bill you in your native currency. This is a complete lie but this is a battle where you have to be prepared. Don't settle for merchants claiming that "it has to be done this way" or "pay cash if you don't want this". Be prepared to walk away, and, if you must complete the transaction, write "DCC refused & merchant didn't give a choice" on the receipt and cross out the amount. Let the merchant know that you will be filing a dispute with your bank.

Disclaimer: Please note any provider recommendations, currency forecasts or any opinions of our authors should not be taken as a reference to buy or sell any financial product.