Recent Guides

By Topic: Foreign Transfers(20) Fx Specialists(12) Large Amounts(11) Travel Money(11) Expat(10) Foreign Currency Accounts(8) Travel Cards(8) Ofx(7) Business Fx Specialists(7) Study Abroad(6) Wise(5) Fx Risk(5) Fx Analysis(4) About Us(4) Popular(3) Revolut(2) Property(2) Travel(1) Banks(1) Online Sellers(1) Pursuits(1)

By Currency: USD(6) AUD(6) JPY(4) CAD(4) EUR(3) SGD(2) THB(2) NPR(1) CNY(1) HKD(1) MXN(1) MYR(1) NOK(1) PHP(1) IDR(1) GBP(1) NZD(1)

Guide to the Euro: Understanding Europe's Common Currency for Travelers, Expats and Business

Understanding the Euro is not only crucial for navigating the financial landscapes of these countries but also for appreciating the broader economic and cultural contexts that shape Europe today.

How to Choose the Best Money Transfer Provider

A comprehensive guide to choosing the best money transfer provider, covering key factors like fees, speed, exchange rates, and customer support, with comparisons of top providers.

Compare the Best Multi-Currency Accounts for Travel, Business & Transfers

We compare the features, exchange rates and security of the three best multi-currency accounts available today — the Wise Account, the WorldFirst World Account, and the OFX Global Currency Account.

How Currency Fluctuations Impact Your Profit Margins (and How to Protect Them)

Currency shifts can quietly shrink your margins if you’re doing business internationally. Learn how to manage FX exposure, protect your profits, and use smart tools to stay ahead.

OFX vs Wise: Which Money Transfer Service Is Best For You in 2026

Looking to transfer money internationally? We compare OFX and Wise side by side, covering costs, exchange rates, speed, and features to help you choose the best service for your needs in 2026.

Wise Review: Is It the Best Way to Transfer Money Internationally?

The Wise Account allows users to hold and convert funds in 40 different currencies and send and spend internationally, all at the “real” exchange rate and with exceptionally low service fees. Users can also receive major-currency payments free of charge.

Guide to the Canadian Dollar (CAD): Travel, Transfers & FX Tips

The Canadian dollar (CAD) is a major global currency closely linked to commodities and US trade. This guide explains how it works and how to manage CAD FX costs.

Understanding the US Dollar: A Guide to America's Currency for Travelers and Investors

The United States dollar is the official currency of the United States of America but also is the world’s dominant reserve currency, and it accounts for roughly 62% of global foreign exchange reserves, double that of the Euro and Yen. In fact, the US Dollar has been the world’s reserve currency for over 100 years.

Guide to the Australian Dollar (AUD): Travel, Transfers & FX Tips

The Australian dollar (AUD) is a major global currency closely linked to commodities and China-led trade. This guide explains how it works and how to manage AUD FX costs.

Biggest Currency Movers – January 2026

January saw clear winners and losers in FX markets, driven by interest rate expectations, risk appetite, and global growth signals.

The Most Expensive FX Mistakes People Make

Foreign exchange mistakes rarely feel expensive at the time — but they add up fast. Here are the most costly FX mistakes people make, and how to avoid them.

How to Receive Freelance Payments from Abroad and Save on Exchange Rates

Freelancers working with overseas clients can lose hundreds to bank fees and bad FX rates. Here’s how to receive international payments safely, cheaply and quickly.

Nepal Raises Daily Remittance Limit to NPR 2.5 Million

Nepal’s central bank has eased foreign exchange rules, increasing the daily inbound remittance cap to NPR 2.5 million (≈ USD 18-20k). Here’s what’s changed and what it means for senders and recipients.

Paying for Overseas Tuition & School Fees

Sending money abroad for tuition or school fees can be costly if you rely on your local bank. Learn how to save on exchange rates and fees by using specialist international transfer providers like Wise, OFX, and XE.

Compare the Best Travel Money Cards for Fees, Exchange Rates & Features

Compare Wise, Revolut, and Travelex travel money cards to find the best option for your next trip. Discover key differences in fees, exchange rates, ATM access, and features to help you save on foreign spending.

What Is the Mid-Market Exchange Rate? Why It Matters for FX Savings

The mid-market rate is the real exchange rate used by banks and markets—but not always passed on to you. Learn how to spot hidden margins and save more when sending or converting money with BestExchangeRates.com.

The Complete Guide to Expats International Money Transfers

Comparing exchange rates can be an important for expats when repatriating overseas funds & earnings.

How to Avoid Hidden Fees on International Money Transfers

When sending money abroad, hidden costs can add up fast. This guide explains the three main fees in foreign transfers—exchange rate margins, provider fees, and bank charges—and shows how to avoid them. Use our tools to compare providers and save up to 5% or more on your next international payment.

Travel Money - Which is Best? Cash or Cards

Multi-currency travel cards are one of the best ways to spend overseas without high bank fees. Learn how they work, their key benefits, and what to watch out for when choosing a travel card for your next trip.

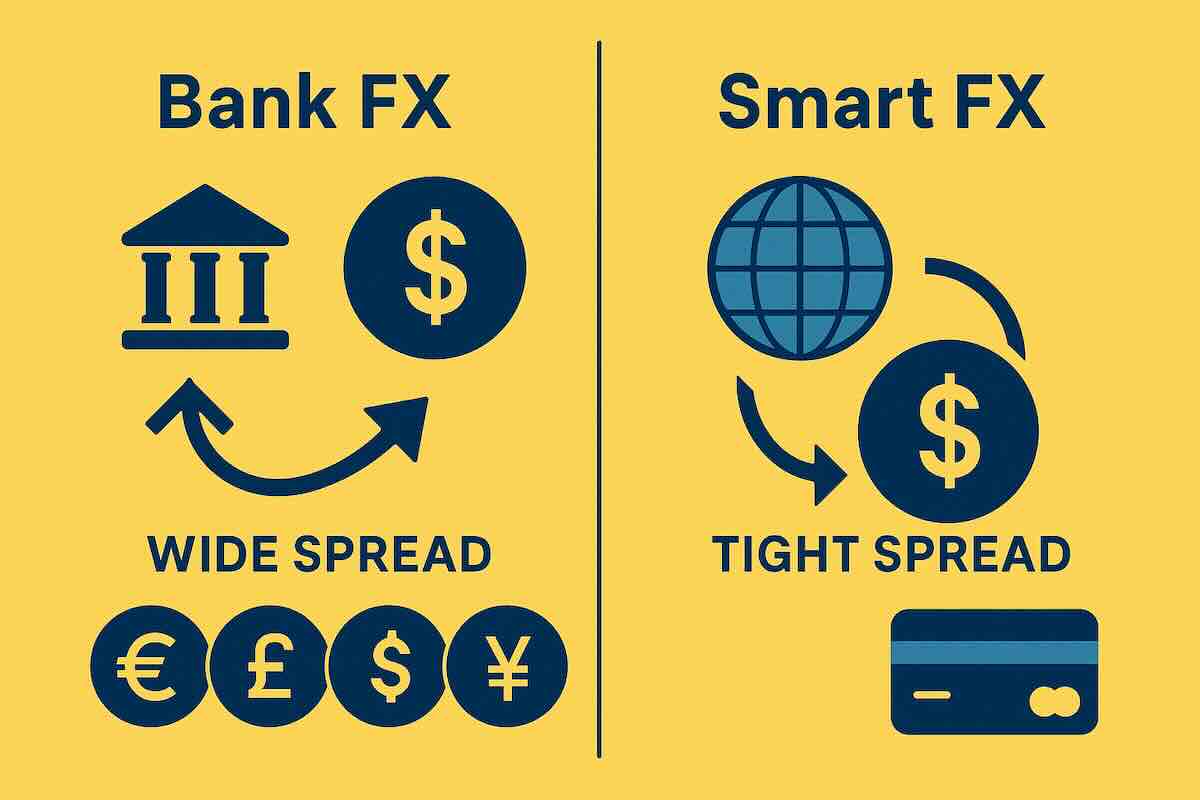

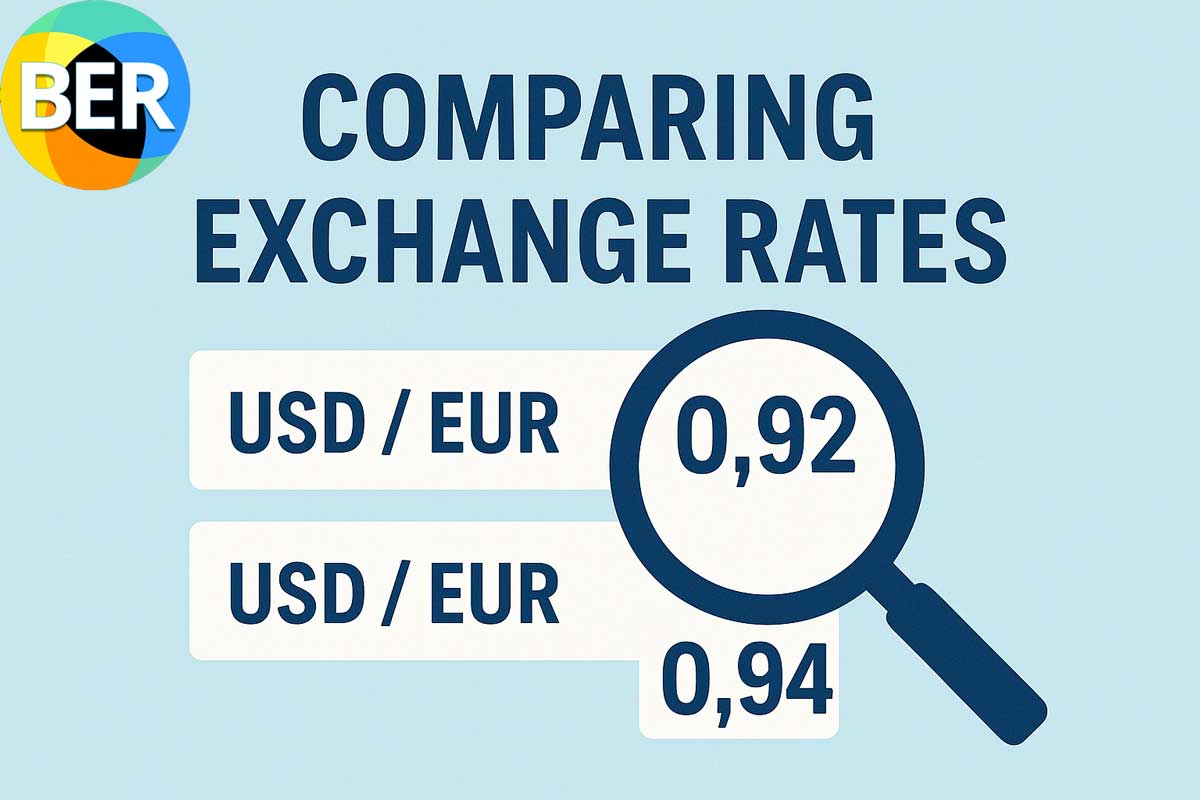

Comparing Bank Exchange Rates

We take a look at why not using your bank for foreign exchange is generally a good idea to save money. As an example, we compare big bank rates for transfers and travel cash to popular foreign exchange specialists, OFX for transfers and Wise for travel money.