How does the BER Rate Tracker work?

Exchange rates are highly volatile, often shifting dramatically from one day to the next. Timing your foreign exchange transaction well can make a real difference to how much you receive. That’s where the BER Rate Tracker comes in—it helps you stay informed and take advantage of the best possible rates.

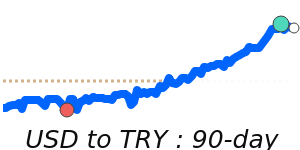

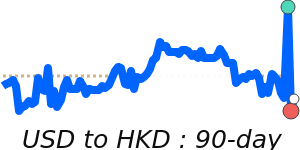

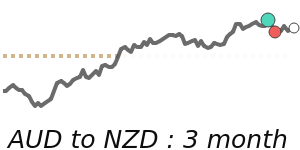

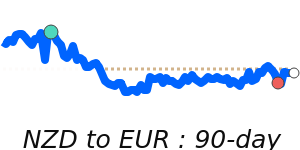

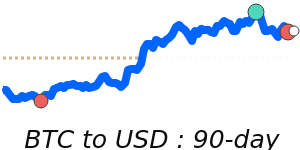

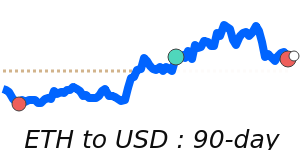

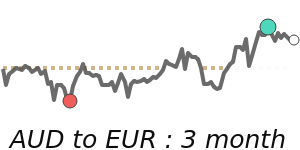

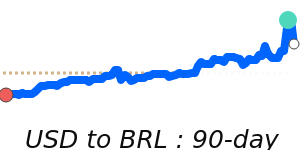

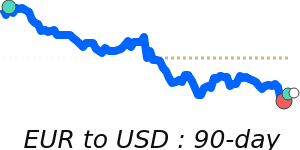

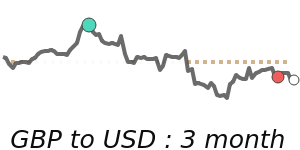

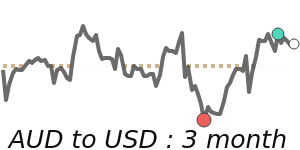

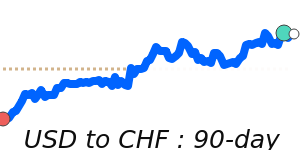

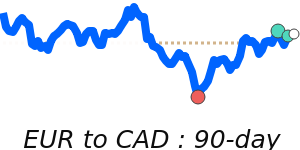

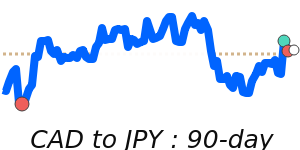

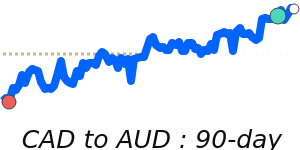

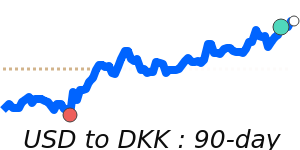

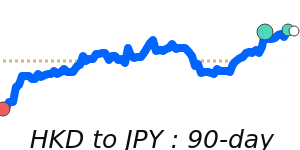

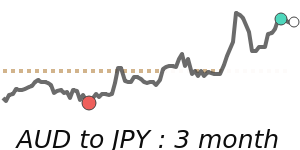

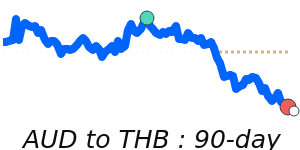

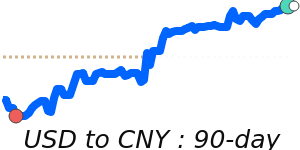

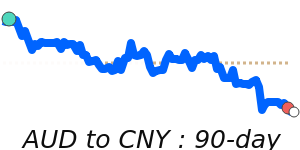

Once you set up your alerts, the BER Rate Tracker will monitor your selected currency pair and send you daily email updates. You’ll get notified whenever there’s a significant change in the exchange rate that matters to you. Each alert also includes an easy-to-read summary of recent trends, showing whether rates have been moving UP 📈 or DOWN 📉 over various time frames, up to 90 days.

Unlike traditional FX alerts that rely on a single target rate, our tracker keeps working continuously, helping you make smarter, better-timed decisions—whether you're planning a one-off transfer or keeping an eye on rates regularly.

With the BER Rate Tracker, you stay informed without the hassle of constant monitoring—your currency updates come straight to your inbox, ready when you need them.

With daily email alerts, you'll be notified when your chosen currency experiences a notable change. Each alert also highlights recent trends—showing whether rates have been trending UP 📈 or DOWN 📉 over periods of up to 90 days—giving you valuable context at a glance.

How Are Our Rate Alerts Different?

Unlike most FX alerts that require you to set a specific target rate, our Smart Rate Tracker does the work for you. It automatically notifies you when significant movements happen in your chosen currency—whether it hits a new daily high/low or shifts noticeably (up or down) over various periods, up to 90 days. No need to set or constantly update a target rate—our alerts keep working in the background as exchange rates evolve.

Why a 90-Day Window?

For most transfers and currency exchanges, the past 90 days provide the most relevant snapshot of rate trends. While longer-term trends may interest traders, we focus on what matters most to typical users: timely, practical insights for near-term FX transactions. By keeping alerts within a 90-day scope, we ensure they're simple, relevant, and actionable.

You can choose to receive daily emails (Monday to Saturday) or opt for alerts only when a new trend emerges. Emails are sent around the New York market close, which is traditionally considered the end of the FX trading day—ensuring you get the latest, most relevant updates.

There are plenty of smart ways to use the BER Rate Tracker to save money. For example, you might split a large transfer into smaller amounts, sending funds when the rate improves or hits a short-term high. Or you can pre-load a travel money card when rates are in your favor, locking in value ahead of a future trip.

If you have any questions or suggestions regarding these alerts please contact us here.