Euro (EUR) Market Update

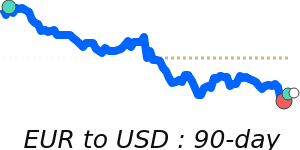

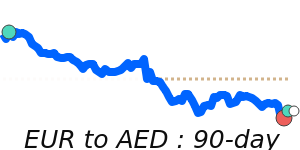

The euro (EUR) recently faced pressure due to the strength of the US dollar (USD), exacerbated by the ongoing trade tensions stemming from the imposition of a 20% reciprocal tariff on EU goods by the US. This development contributes to a negative correlation, leading analysts to observe that the euro's value typically declines as the USD strengthens.

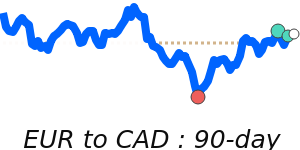

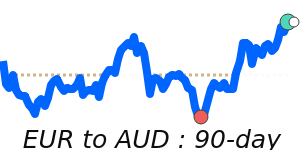

However, the euro found some support at the beginning of the European trading session, buoyed by stronger-than-expected industrial production figures from Germany. This positive economic data allowed the euro to recover slightly against other weaker currencies.

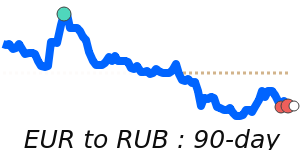

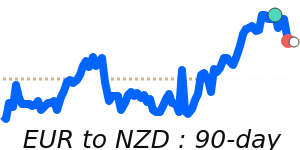

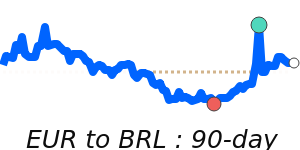

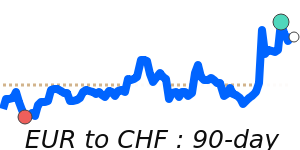

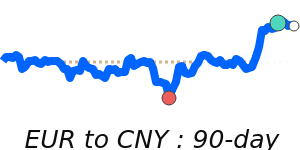

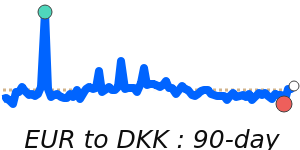

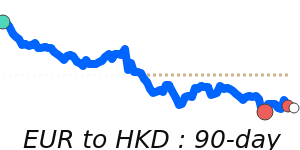

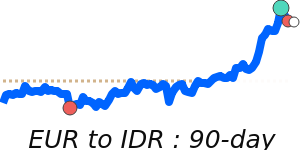

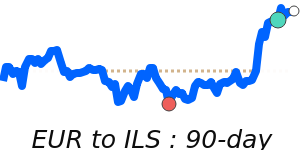

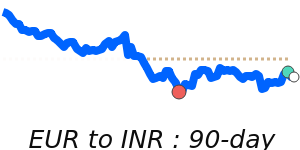

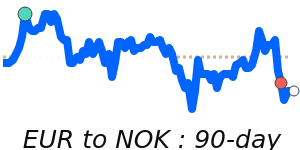

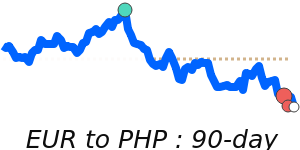

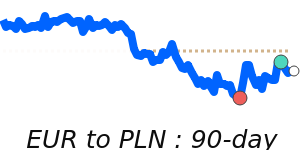

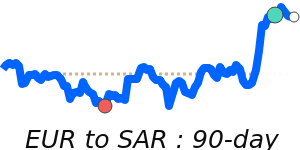

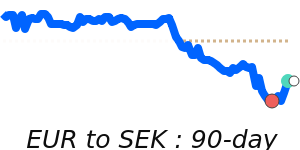

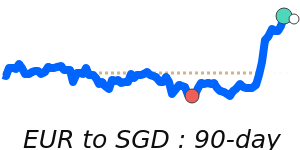

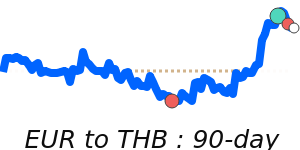

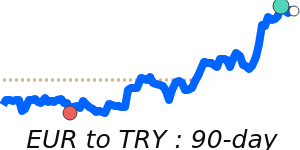

Current exchange rates show the EUR/USD trading at 14-day lows around 1.1226, which is approximately 3.0% above its three-month average of 1.0904. The pair has exhibited significant volatility, with fluctuations ranging from 1.0307 to 1.1513. The EUR/GBP, on the other hand, stands at 0.8481, just 0.7% above its three-month average of 0.8426, indicating relative stability within a 5.3% range. Additionally, the EUR/JPY trades at 163.8, which is 1.9% above its three-month average, having fluctuated within a 5.4% range recently.

Geopolitical factors, particularly the ongoing war in Ukraine, continue to influence the euro’s performance. The European Union's financial commitments to Ukraine and energy supply disruptions stemming from the conflict add layers of uncertainty to the Eurozone's economic outlook. Observers note that the euro remains sensitive to shifts in global market sentiment and political developments, which could lead to further volatility.

Moreover, the euro's value is closely linked to macroeconomic indicators and the monetary policy decisions of the European Central Bank (ECB). As the ECB navigates challenges related to inflation and economic growth, any interest rate adjustments will play a critical role in shaping the euro's trajectory. For instance, heightened inflation pressures have historically led the ECB to consider tightening monetary policy, which could bolster the euro if executed effectively.

Lastly, movements in oil prices also have implications for the euro, given the Eurozone's dependence on energy imports. Current data shows Brent Crude OIL/USD at 62.84, which is 9.8% below its three-month average. This declining trend in oil prices may reflect broader economic concerns and could further impact the euro as energy costs remain a crucial factor for economic stability. Markets will continue to monitor these developments closely, as they remain integral to understanding the euro's future performance.