Euro (EUR) Market Update

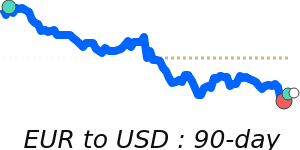

The euro (EUR) has shown resilience in recent trading, bolstered by a hawkish stance from the European Central Bank (ECB). Following the ECB's latest interest rate decision, President Christine Lagarde signaled that the bank is nearing its neutral rate, which has led to a rally in the euro. Analysts note that the EUR has reached 30-day highs near 1.1453 against the USD, a notable 2.6% increase above its three-month average of 1.116. The EUR/USD pair has remained relatively stable, trading within a 7.1% range from 1.0754 to 1.1513.

Despite these gains, the euro faces potential headwinds from disappointing economic data emerging from Germany, the Eurozone's largest economy. Forecasts suggest contraction in exports and industrial production for April, which could dampen investor confidence in the euro as the day progresses. As Europe grapples with the repercussions of geopolitical tensions, particularly the ongoing war in Ukraine, economic indicators from member states will continue to play a critical role in shaping the currency's trajectory.

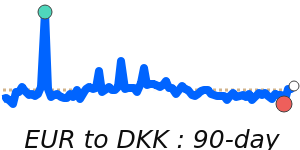

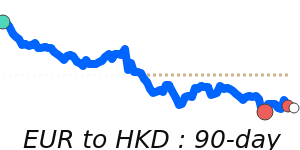

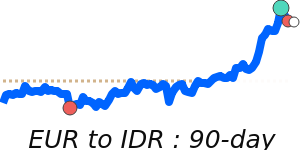

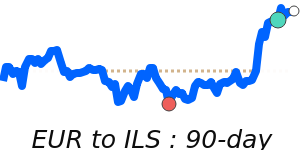

A glance at other currency pairs reveals that the EUR is at 0.8433 against the GBP, just below its three-month average, with stable trading in a 4.2% range from 0.8337 to 0.8683. Against the JPY, the euro is at 14-day highs near 164.4, performing 1.2% above its three-month average of 162.5 and trading within a tight 4.0% range from 158.6 to 165.0.

The influence of global oil prices on the euro remains pertinent as well. Currently, oil is priced at 65.34 USD, reflecting a 2.3% dip below its three-month average of 66.91, traversing a volatile 24.7% range from 60.14 to 75.02. Fluctuations in oil prices could impact inflation and economic performance across the Eurozone, further complicating the outlook for the euro.

In summary, while the euro is witnessing a transient strengthening due to ECB signals, incoming data from Germany and the implications of global events will be crucial in determining its short-term performance and broader economic stability in the Eurozone.