EUR Market Update

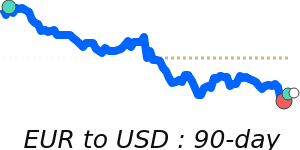

The euro remains largely unsettled amid ongoing geopolitical tensions and rising energy costs. Despite Eurozone unemployment hitting a record low, the euro has experienced some downside, mainly against the US dollar, which is currently seen as a safer haven. EUR/USD is trading around 1.1623, slightly below its 3-month average, reflecting cautious investor sentiment.

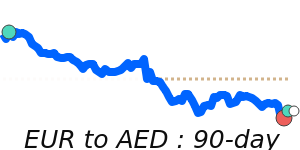

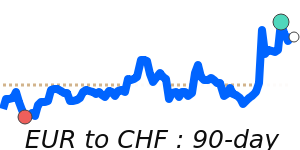

The escalation in Middle East tensions has pushed oil prices higher, which generally impacts the euro negatively due to Europe’s energy reliance. The euro also shows a modest decline against the Swiss franc, trading near 0.9034, influenced by safe-haven flows into CHF. Meanwhile, the euro's performance against the British pound has been stable, with EUR/GBP around 0.8678, but remaining slightly below its recent range.

In volatile conditions driven by energy fears and geopolitical concerns, the euro tends to weaken compared to safer currencies. Investors should watch for short-term opportunities as any easing of tensions or a slowdown in oil price rises could provide relief for the euro. Otherwise, downside risks prevail until clarity emerges.