EUR Market Update

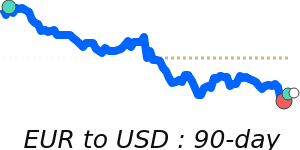

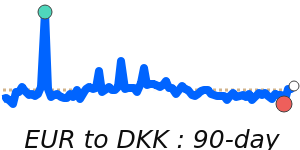

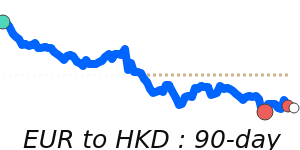

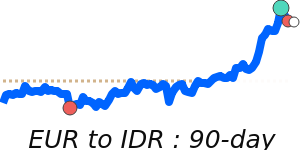

The euro has seen a slight rebound, trading around 1.1645 against the US dollar after dropping close to 1.1507 recently. This recovery is supported by rising oil prices and shifting expectations about the US Federal Reserve's interest rate moves. Investors are watching US economic data, particularly employment and services figures, which could influence the dollar and affect the euro’s short-term direction.

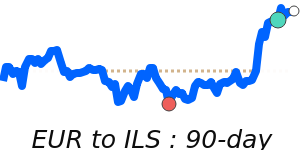

Against the British pound, EUR has dipped to 0.8653, near its 30-day lows, reflecting ongoing caution amid geopolitical concerns and European economic signals. Meanwhile, the euro remains near its recent high against the Japanese yen at 183.6, staying within a stable range, as markets largely hold steady ahead of upcoming economic releases.

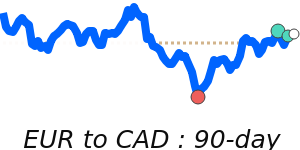

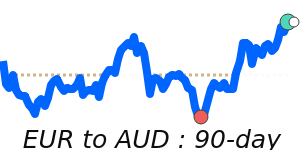

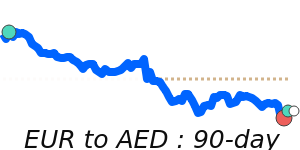

Overall, the euro is consolidating within recent ranges, with expectations of gradual appreciation as the European economy remains resilient and inflation pressures ease. Traders should stay alert to geopolitical developments and US data, which could sway the EUR/USD pair in the coming weeks. The euro remains well-supported against some currencies, but broader factors like oil prices and monetary policy outlooks continue to shape its direction.