KRW & INR - Markets & outlook

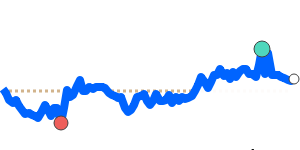

South Korean won - KRW:

South Korean won - KRW:

The US imposed a 25% reciprocal tariff rate on goods from South Korean as part of Trump’s growing trade war with countries around the world.

The outlook for emerging Asian currencies is worsening again after US President Donald Trump announced a raft of new tariffs globally, curbing optimism that his threats were mainly bargaining ploys.

Martial Law Crisis

South Korean President Yoon Suk Yeol’s brief imposition of martial law in early December triggered a political crisis, with the opposition demanding his impeachment and treason charges.

The move sparked widespread protests, drawing parallels to the nation’s authoritarian past, and blindsided his party, the public, and international allies like the US. The fallout has not only destabilized domestic politics but also raised concerns about South Korea’s sovereign-debt rating and heightened volatility for the won amid fears of prolonged political deadlock.

However, South Korea’s won quickly pared its losses against the U.S. dollar following the swift passage of a parliamentary resolution calling for the lifting of martial law.

Indian rupee - INR:

Indian rupee - INR:

The Indian rupee has steadily weakened (like most currencies) against the US dollar on fears that surging energy prices could spur inflation and interest rate hikes.

India is the third-largest oil-consuming country, after the U.S. and China.

India imports most of its oil requirements and higher crude prices tend to push up domestic inflation.

Investors are shedding Asian currencies including the Indian rupee as the dollar surges against major counterparts, driven by expectations that Trump’s anticipated policies—lower corporate taxes and deregulation—will stimulate U.S. growth.

Additionally, Asian currencies face the potential impact of Trump increasing tariffs, particularly targeting China. This combination is expected to bring a phase of heightened uncertainty and volatility for Asian currencies, with bankers noting that even the typically stable Indian rupee will feel the effects of the disruptions Trump’s policies may introduce.