NOK & INR - Markets & outlook

Norwegian krone - NOK:

Norwegian krone - NOK:

NOK has rocketed higher in the past few weeks, currently up 9% year-to-date versus the dollar. That is largely due to a boost in European economic and equity sentiment, but the inflation surprise in Norway played a key role. Markets are pricing in only 8bp of easing for 27 March and only one cut in the next 12 months.

ABN-Amro's fair value model shows EUR/NOK is undervalued relative to short-term drivers, embedding an excess of optimism relative to European spending optimism and rotation from US equities back to Europe.

So, while EUR/NOK could remain pressured this week after a Norges Bank hold, ABN-Amro are less optimistic about further gains and actually see room for a EUR/NOK rebound to 11.50 in the second quarter, when US tariffs may materially temper European sentiment.

Indian rupee - INR:

Indian rupee - INR:

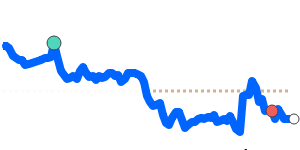

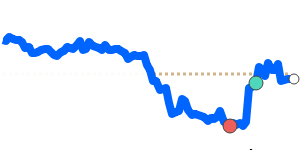

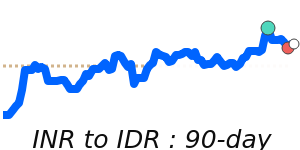

The Indian rupee has steadily weakened (like most currencies) against the US dollar on fears that surging energy prices could spur inflation and interest rate hikes.

India is the third-largest oil-consuming country, after the U.S. and China.

India imports most of its oil requirements and higher crude prices tend to push up domestic inflation.

Investors are shedding Asian currencies including the Indian rupee as the dollar surges against major counterparts, driven by expectations that Trump’s anticipated policies—lower corporate taxes and deregulation—will stimulate U.S. growth.

Additionally, Asian currencies face the potential impact of Trump increasing tariffs, particularly targeting China. This combination is expected to bring a phase of heightened uncertainty and volatility for Asian currencies, with bankers noting that even the typically stable Indian rupee will feel the effects of the disruptions Trump’s policies may introduce.