PLN & INR - Markets & outlook

Polish zloty - PLN:

Polish zloty - PLN:

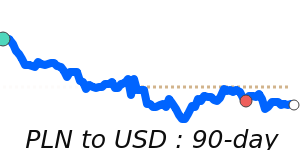

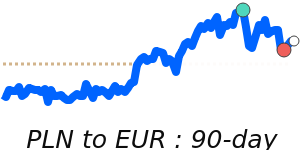

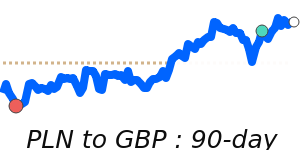

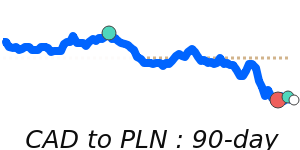

The Polish zloty has fallen nearly 3 per cent against the euro since the National Bank of Poland’s shock decision to slash interest rates in September.

Poland’s central bank governor Adam Glapiński said the decision was based on a “radically changed” economic outlook, with the prospects of a recession in Germany particularly worrisome for Polish exports.

Poland is connected by the umbilical cord to Germany, which is in a sort of stagflation.

The German economy has been deteriorating rapidly, with industrial production falling more sharply than forecast.

In Polish economy and zloty have been impacted by War in Ukraine. The Zloty was trading at around 4.0 to the USD before Russia invaded Ukraine.

Indian rupee - INR:

Indian rupee - INR:

The Indian rupee has steadily weakened (like most currencies) against the US dollar on fears that surging energy prices could spur inflation and interest rate hikes.

India is the third-largest oil-consuming country, after the U.S. and China.

India imports most of its oil requirements and higher crude prices tend to push up domestic inflation.

Investors are shedding Asian currencies including the Indian rupee as the dollar surges against major counterparts, driven by expectations that Trump’s anticipated policies—lower corporate taxes and deregulation—will stimulate U.S. growth.

Additionally, Asian currencies face the potential impact of Trump increasing tariffs, particularly targeting China. This combination is expected to bring a phase of heightened uncertainty and volatility for Asian currencies, with bankers noting that even the typically stable Indian rupee will feel the effects of the disruptions Trump’s policies may introduce.