Australian dollar - AUD:

Australian dollar - AUD:

The Australian dollar (AUD), often called the “Aussie,” is one of the most actively traded currencies in the world, influenced by a variety of domestic and global factors. As a commodity currency, its value is closely tied to the price of key Australian exports such as iron ore, coal, and natural gas. When demand for these commodities rises, the AUD typically strengthens, whereas a decline in prices can lead to depreciation.

Interest rates set by the Reserve Bank of Australia (RBA) also play a crucial role in the currency’s performance. Higher interest rates attract foreign investment, increasing demand for the AUD, while lower rates reduce investor interest and weaken the currency. The Australian dollar is often part of the carry trade, where investors borrow in low-interest currencies like the Japanese yen to invest in AUD, benefiting from its relatively higher yields.

Market sentiment is another major driver. The AUD is considered a risk-on currency, meaning it tends to appreciate when investors are optimistic and global markets are stable. However, during times of uncertainty—such as financial crises or geopolitical tensions—investors shift towards safe-haven currencies like the U.S. dollar or Japanese yen, pushing the AUD lower. Economic data, including employment numbers, inflation, and GDP growth, can also impact the currency’s movement, as strong economic indicators typically support a stronger AUD.

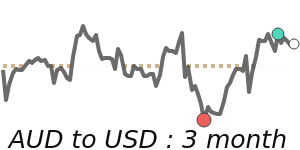

Australia’s economic ties to China, its largest trading partner, further influence the currency. If China’s economy is booming, demand for Australian exports increases, strengthening the AUD. Conversely, a slowdown in China can hurt commodity exports and weaken the Aussie dollar. Additionally, fluctuations in the U.S. dollar (USD) impact AUD/USD trading, one of the most widely traded currency pairs. A stronger USD often results in a weaker AUD and vice versa.

Global trade policies, political stability, and market hours also shape how the AUD trades. Liquidity is highest during the Asian and European trading sessions when Australian and global financial markets are active. Due to its exposure to commodities and investor sentiment, the AUD tends to be more volatile than other major currencies. Looking ahead, trends in sustainability, global trade, and shifting interest rate policies will continue to shape the AUD’s performance on the world stage.