SEK & INR - Markets & outlook

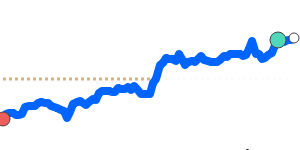

Swedish krona - SEK:

Swedish krona - SEK:

Sweden’s central bank has left the door wide open to a May rate cut should inflation data continue to look better. We now think the Riksbank will move a month earlier than the ECB, where we expect the first cut in June. However, markets are already betting on a May move, and domestic monetary policy should remain secondary to external drivers for SEK.

In what would be a major policy shift for one of the world's most cautious monetary authorities, the governor of Sweden's central bank left the door open for the Riksbank to raise interest rates as soon as this year.

Finishing their economic recovery, the Nordic nation has now found themselves experiencing inflation.

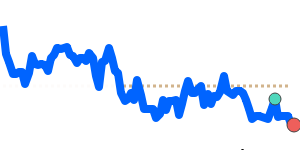

Indian rupee - INR:

Indian rupee - INR:

The Indian rupee has steadily weakened (like most currencies) against the US dollar on fears that surging energy prices could spur inflation and interest rate hikes.

India is the third-largest oil-consuming country, after the U.S. and China.

India imports most of its oil requirements and higher crude prices tend to push up domestic inflation.

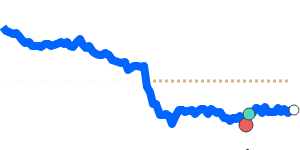

Investors are shedding Asian currencies including the Indian rupee as the dollar surges against major counterparts, driven by expectations that Trump’s anticipated policies—lower corporate taxes and deregulation—will stimulate U.S. growth.

Additionally, Asian currencies face the potential impact of Trump increasing tariffs, particularly targeting China. This combination is expected to bring a phase of heightened uncertainty and volatility for Asian currencies, with bankers noting that even the typically stable Indian rupee will feel the effects of the disruptions Trump’s policies may introduce.