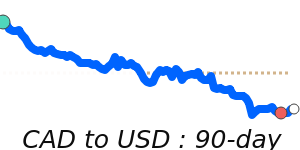

Forecasts for BTC to CAD

![]()

![]() ### BTC to CAD Outlook

In the near term, BTC/CAD is trading close to recent lows and dominated by risk-off sentiment. Current conditions suggest a weaker bias, held down by heightened risk aversion and geopolitical tensions. The pair’s current level remains supported by a broad risk-off environment but faces downside pressure if risk sentiment persists.

### BTC to CAD Outlook

In the near term, BTC/CAD is trading close to recent lows and dominated by risk-off sentiment. Current conditions suggest a weaker bias, held down by heightened risk aversion and geopolitical tensions. The pair’s current level remains supported by a broad risk-off environment but faces downside pressure if risk sentiment persists.

### Transfer implications

- **Expats:** sending Bitcoin to pay Canadian Dollar invoices may find this less favourable than recent levels.

- **Travellers:** exchanging foreign cash for CAD could see less advantageous rates if Bitcoin continues to weaken.

- **Businesses:** paying overseas invoices in CAD with Bitcoin may face increased costs amid the recent trend.

### Key drivers

- **Rate gap:** Bitcoin’s yield and policy stance remain dynamic but are not enough to offset global risk aversion.

- **Risk/commodities:** Risk-off conditions driven by geopolitical tensions and oil price swings remain influential.

- **Global factors:** US dollar safe-haven flows continue to support the CAD as global risk sentiment stays cautious.

### What could change it

- **Upside risk:** Risk sentiment stabilizes, easing fears and prompting a recovery in Bitcoin.

- **Downside risk:** Escalation of geopolitical tensions or further risk aversion intensifies pressure on the pair.