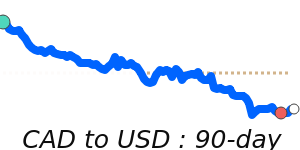

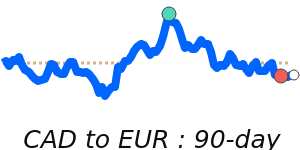

The Canadian dollar (CAD), commonly referred to as the "loonie," remains stable amid recent fluctuations in oil prices and ongoing trade policy uncertainties. As of the latest reports, the CAD is trading at 0.7309 against the USD, which is 1.9% above its three-month average of 0.717, reflecting a relatively narrow trading range of just 3.3% from 0.7084 to 0.7315. Against the EUR, it has seen minimal movement, currently at 0.6208, only 0.8% above its three-month average.

Market analysts indicate that the stability of the CAD can be attributed to the essential nature of oil prices in the Canadian economy, with Canada being one of the largest oil exporters globally. Recent data shows oil trading at 60.89 USD, which is notably 3.9% below its three-month average of 63.35. This presents a challenge for the CAD, as fluctuations in oil prices directly impact revenue and, consequently, the currency's strength.

Trade policy remains a critical factor, with the introduction of U.S. tariffs on Canadian imports earlier this year fostering a retaliatory response from Canada. This escalating trade tension adds an element of volatility to the CAD, particularly against the backdrop of differing interest rates, as the Bank of Canada holds steady at 2.25% while potential U.S. rate cuts loom. This divergence may pressure the CAD against the USD.

Importantly, economic indicators such as Canada's GDP growth of 2.6% and an unemployment rate decrease to 6.5% in November provide some resilience to the loonie, hinting at a potential rebound in retail sales that could further support the currency. However, analysts advise caution, as the impact of global economic trends and investor sentiment will continue to play a significant role in the CAD's trajectory. Overall, the outlook for the CAD hinges on the interplay between oil market movements, domestic economic performance, and external trade relations.