Outlook

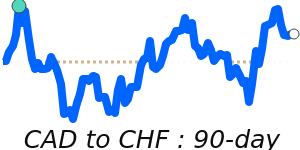

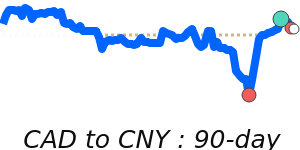

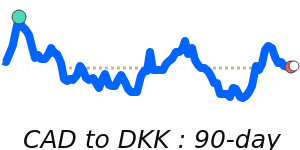

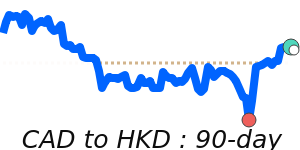

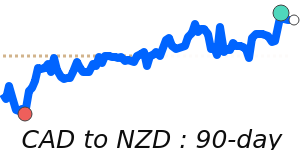

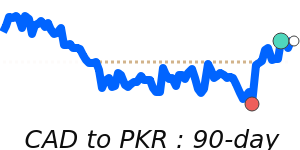

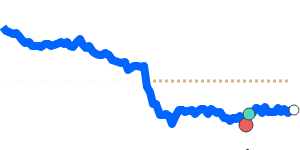

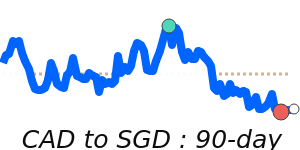

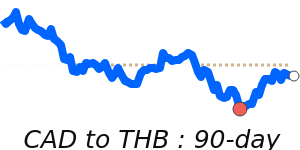

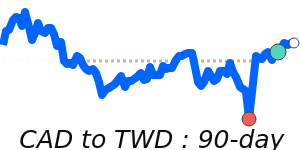

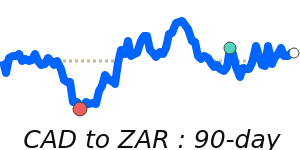

The CAD faces a mixed path. Oil strength and a steady BoC backdrop support the loonie, but GDP fell in Q4 2025 and the Fed is expected to ease, limiting upside. If oil holds gains and risk appetite improves, the CAD could test the upper end of its ranges.

Key drivers

- Domestic data: Q4 GDP fell 0.2%; December payrolls rose, signaling labor resilience.

- Policy divergence: BoC at 2.25% vs Fed easing toward the mid-3% zone by year-end.

- Oil and commodities: Oil sits near 90-day highs around the high-70s; Canada’s energy link supports the CAD.

- Trade/tariffs: US tariff framework adds policy risk for Canada’s currency.

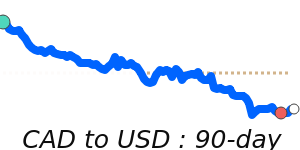

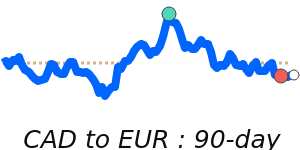

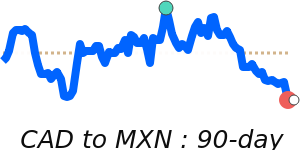

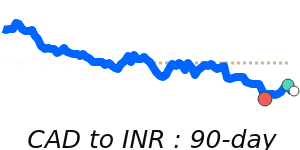

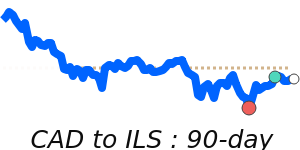

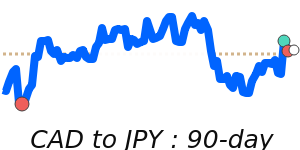

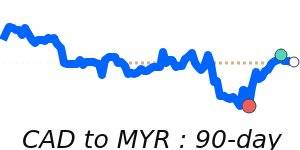

Range

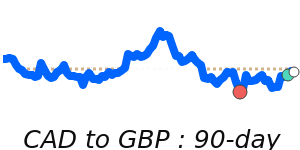

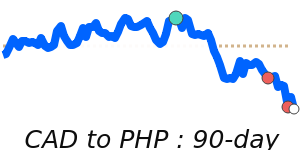

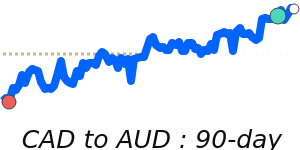

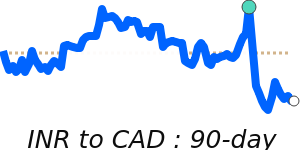

CAD/USD: 0.7314, range 0.7142–0.7413. CAD/EUR: 0.6224, range 0.6120–0.6224. CAD/GBP: 0.5458, range 0.5322–0.5458. CAD/JPY: 114.6, range 111.0–115.3. Brent Crude OIL/USD: 78.37, range 59.04–78.37.

What could change it

- Oil price direction shifts.

- Unexpected BoC policy shift (rate change).

- US tariff policy developments.

- Surprises in Canadian data (growth or employment).