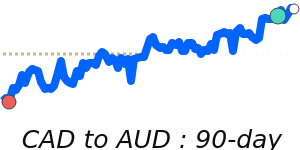

The Canadian dollar (CAD), also known as the "loonie," has shown some stability recently, recovering from losses following the Canadian government's withdrawal of its digital tax plans and the resumption of trade talks with the United States. Analysts view this development as a positive signal for trade relations, which could bolster the CAD in the near term.

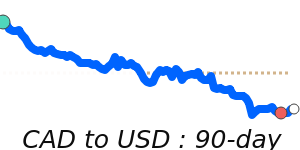

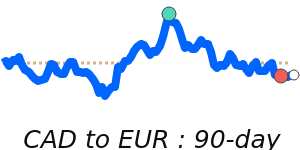

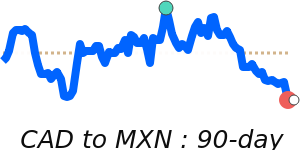

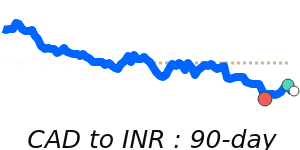

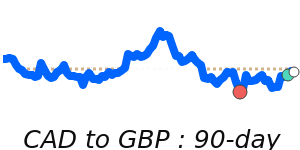

Recent data places CAD to USD at 0.7350, marking a 7-day high and up 1.6% from its 3-month average of 0.7231. The loonie seems to have traded within a relatively stable range between 0.6991 and 0.7369. Meanwhile, key pairs against the euro and the pound demonstrate some challenges, with CAD to EUR at 0.6235, 2.1% below its 3-month average, and CAD to GBP at 0.5352, 1.1% below its 3-month average.

Factors influencing the CAD include fluctuations in oil prices, which remain crucial given Canada's status as a major oil exporter. Currently, oil is trading at 67.61 USD, 1.2% above its 3-month average, reflecting some stability within a volatile range of 60.14 to 78.85. Rising oil prices typically bolster the CAD, providing a cushion against depreciation as they boost Canada's revenue from exports.

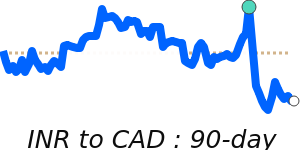

The market is also wary of ongoing trade tensions that could impact the CAD's strength, particularly after the U.S. imposed tariffs on Canadian metals earlier this year. Analysts caution that persistent uncertainties in U.S. trade policies may limit the loonie's upside potential.

Additionally, the Bank of Canada has paused interest rate cuts, maintaining the rate at 2.75%, which supports the currency. This decision reflects a commitment to stabilizing the economy, though careful monitoring of inflation and employment data will be crucial for future policy changes.

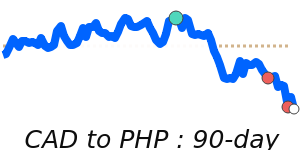

Overall, the CAD's performance will largely depend on the dynamics of oil prices, trade-related developments, and the ongoing economic relationship with the United States. Investors should stay attuned to these factors, as they will be pivotal in shaping the loonie's trajectory in the coming weeks.