Canadian dollar (CAD) Market Update

The Canadian dollar (CAD), commonly referred to as the "loonie," faced downward pressure recently, primarily due to falling oil prices. As a commodity-linked currency, the CAD tends to move in sync with oil prices, and its value has been negatively impacted by a drop in global crude prices. Market analysts have noted that the CAD fell against stronger rivals yesterday, with no notable Canadian economic data to support the currency, leaving it vulnerable to the fluctuations in the oil market.

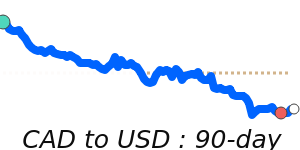

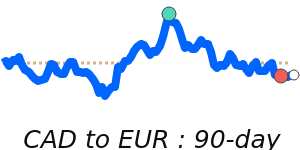

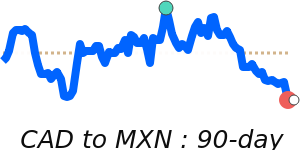

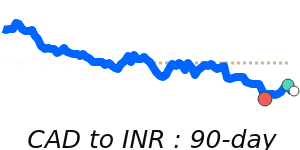

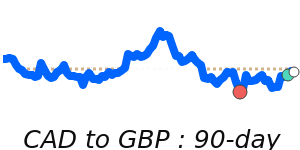

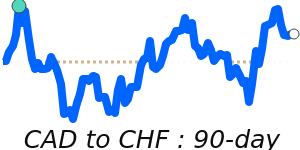

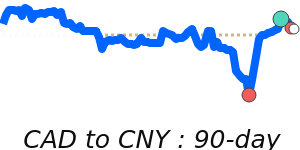

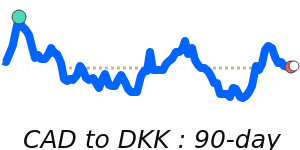

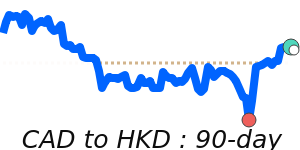

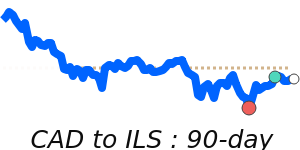

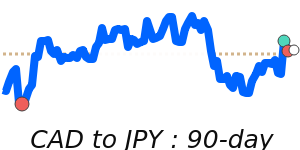

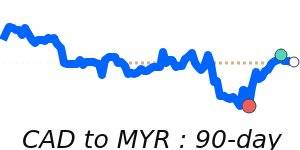

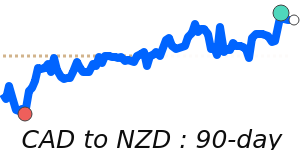

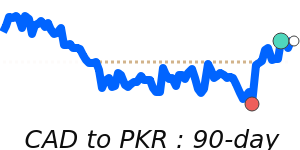

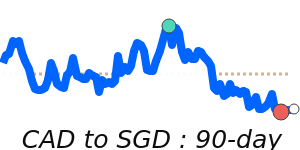

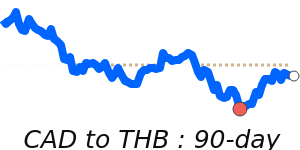

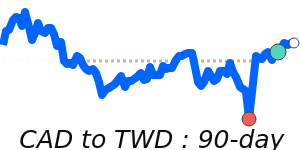

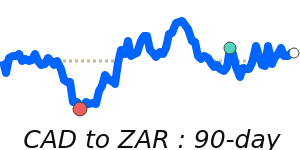

Currently, the CAD is trading at 7-day lows near 0.7201 against the US dollar, which is significantly positioned 2.5% above its 3-month average of 0.7022. Over the past three months, this exchange rate has exhibited relative stability, fluctuating in a 6.4% range from a low of 0.6801 to a high of 0.7239. Meanwhile, against the Euro, the CAD at 0.6314 stands 3.1% below its 3-month average of 0.6519 and has shown more volatility, trading in an 8.1% range from 0.6275 to 0.6784. The CAD is also down against the British pound, currently at 0.5409, which is 1.3% below its 3-month average of 0.548, while trading stability reflects a modest range of 5.7% from 0.5347 to 0.5651. against the Japanese yen, the CAD is at 103.5, 1.1% below its 3-month average of 104.6, within a stable range of 6.9% from 101.8 to 108.8.

Notably, oil prices are currently trading at $66.87, which is 6.8% below their 3-month average of $71.74. This decline has significant implications for the CAD as Canada is one of the largest oil exporters globally, making the currency highly sensitive to changes in crude prices. In addition to oil price dynamics, analysts suggest that the future trajectory of the loonie will also depend on the Bank of Canada’s monetary policy and the broader economic outlook, particularly in relation to the U.S. market, which remains a key trading partner for Canadian goods and services.

As the Canadian economy continues to diversify, economic indicators such as inflation and employment data will be essential for traders keeping an eye on CAD developments. Overall, recent trends suggest caution for CAD traders, as the loonie's performance will largely be shaped by external factors, particularly fluctuations in oil prices and adjustments in U.S. economic activity.