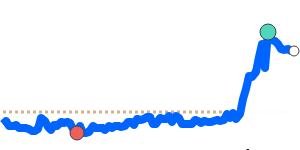

The Swiss franc (CHF) has recently enjoyed a notable increase in value, reflecting its status as a safe-haven currency amidst rising global trade tensions and tariff disputes. Analysts have noted that the CHF has reached a decade high above 1.22 against the USD, supported by a flight to safety as investors react to ongoing uncertainty in trade negotiations—especially following the US's imposition of significant tariffs. Treasury Secretary Bessent's comments regarding the length of potential negotiations have further fueled this demand for safer assets.

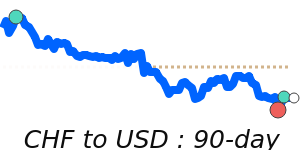

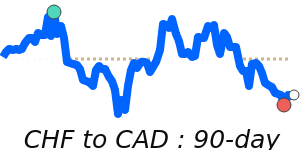

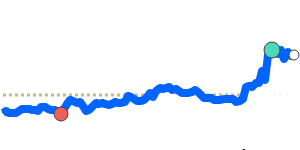

Current market data reveals that the CHF to USD has reached 90-day highs near 1.2647, which is significantly 4.1% above the three-month average of 1.2143. The trading range has been notably volatile, with fluctuations of 11.5% from 1.1339 to 1.2647, indicating a strong response from traders to emerging economic news.

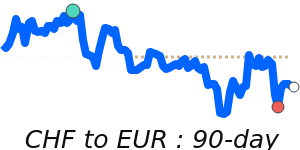

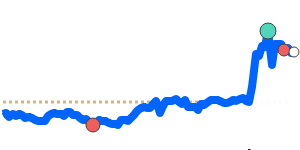

Against the Euro (EUR), the CHF is also performing well, currently at 30-day highs near 1.0714—slightly above its three-month average. The CHF to EUR exchange rate has shown relative stability, trading within a 3.8% range from 1.0445 to 1.0838. This stability can be linked to Switzerland's strong economic ties with the Eurozone, and experts suggest that robust Eurozone performance generally bolsters the CHF.

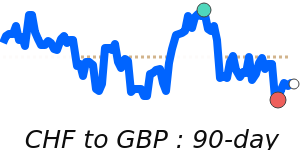

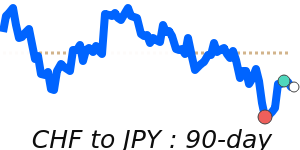

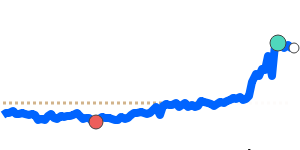

On the other hand, the CHF to GBP has reached 60-day highs at 0.9200, which is 1.3% above its three-month average of 0.9081, while trading within a stable 7.6% range from 0.8720 to 0.9385. The relationship with the Japanese yen (JPY) also demonstrates strength; the CHF to JPY is at 181.5, 3.5% above its three-month average, confined within a 7.3% trading range from 169.3 to 181.6.

Overall, the Swiss franc's ascendancy reflects broader market trends tied to economic uncertainties and ongoing geopolitical events. Analysts will continue to monitor the impacts of Eurozone economic health and potential interventions from the Swiss National Bank (SNB) as the CHF remains interconnected with both regional and global economic conditions.