Outlook

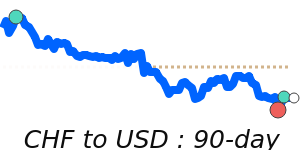

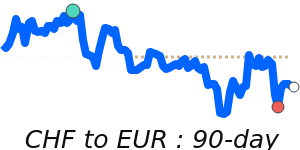

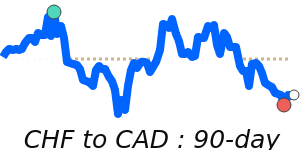

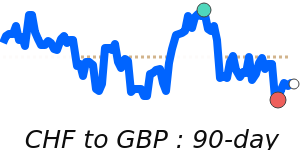

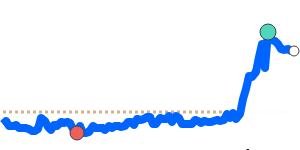

The Swiss franc remains a clear safe-haven bid amid ongoing global uncertainty and geopolitical tensions. The debate over where SNB policy goes next—given deflationary pressures and a historically strong franc—keeps the franc sensitive to both policy signals and risk sentiment. In January 2026, the CHF showed strength against the dollar, illustrating its status as a preferred safe-haven asset, even as it softened versus the euro on some weeks. The SNB has kept the policy rate at 0% since March 2024, aiming to support inflation and the export sector, and it remains vigilant about preventing excessive franc appreciation through potential intervention if needed. Market data show CHF/USD at 1.2923, about 1.8% above its 3-month average of 1.2691, with a stable 5.8% range from 1.2392 to 1.3115; CHF/EUR around 1.0977, roughly 1.6% above its 3-month average of 1.0805 (range 1.0648–1.0977); CHF/GBP at 0.9576 (about 1.7% above 3-month average of 0.9414; range 0.9298–0.9582); and CHF/JPY near 201.5, about 1.8% above its 3-month average of 198 (range 193.0–203.4). The combination of safe-haven demand, global trade tensions, and SNB policy dynamics suggests continued volatility with a bias toward CHF strength in risk-off environments, but potential pullbacks if risk appetite improves or if policy actions cap gains.

Key drivers

- Safe-haven demand continues to support the CHF as global uncertainties persist, reinforced by geopolitical tensions.

- SNB policy stance and currency-management approach remain a key proof point; with the rate at 0% since March 2024, intervention remains a possibility if the franc strengthens excessively and hurts exports.

- Global trade tensions and geopolitical developments keep the CHF in demand during risk-off periods.

- The export exposure has historically faced shocks when policy or external factors shift, such as the 2025 tariff surprise, which underscores the sensitivity of the franc to external shocks and policy responses.

Range

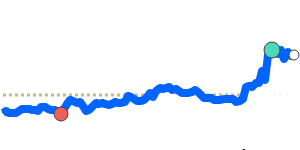

CHF/USD: current 1.2923; 3-month average 1.2691; range 1.2392–1.3115.

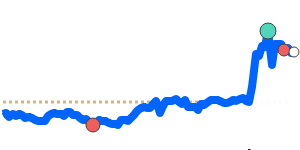

CHF/EUR: current 1.0977; 3-month average 1.0805; range 1.0648–1.0977.

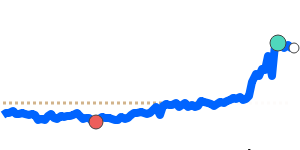

CHF/GBP: current 0.9576; 3-month average 0.9414; range 0.9298–0.9582.

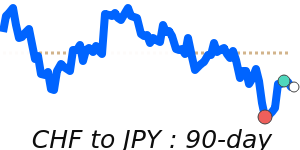

CHF/JPY: current 201.5; 3-month average 198; range 193.0–203.4.

What could change it

- A shift in global risk sentiment: a move from risk-off to risk-on could reduce safe-haven demand for the CHF and weaken it versus the USD and other currencies.

- SNB policy actions or communications: explicit signs of intervention to cap gains or, conversely, a pivot to a different policy stance could move the franc.

- Changes in global trade dynamics or geopolitical developments: easing tensions could soften CHF strength; renewed tensions could bolster it further.

- Major central bank divergence: relative policy changes in the Fed, ECB, or other large economies could tilt USDCHF and other CHF pairs, affecting demand for the franc.