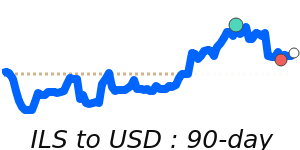

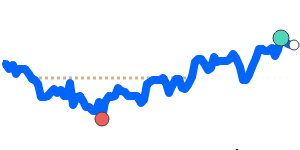

USD/ILS Outlook:

The USD/ILS exchange rate is slightly weaker, likely to move sideways as it trades 2.3% below the recent three-month average and is well within mid-range.

Key drivers:

• Rate gap: The Federal Reserve's policy of maintaining higher interest rates contrasts with the Bank of Israel's recent rate cut, which has weakened the USD relative to ILS.

• Risk/commodities: The recent increase in crude oil prices has pressured global risk appetite, impacting the USD negatively as oil remains a key commodity tied to the currency's strength.

• One macro factor: The forecasted contraction in US durable goods orders could further dampen the USD's strength in the near term.

Range:

The USD/ILS is expected to drift within its recent range, as external pressures and local market dynamics balance each other out.

What could change it:

• Upside risk: A surprising strength in upcoming US employment data could boost the USD back towards recent highs.

• Downside risk: Continued strengthening of the ILS due to improved investor confidence could push the USD/ILS lower.