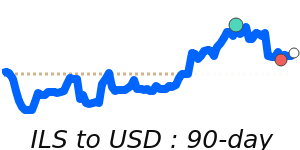

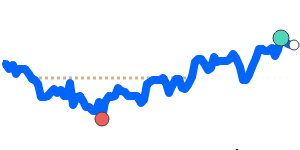

USD/ILS Outlook:

The USD/ILS is slightly positive and likely to move sideways, trading near its 90-day average and within a stable range.

Key drivers:

• Rate gap: The Federal Reserve's recent interest rate hikes continue to support the USD, while the Bank of Israel has cut rates, raising pressure on the ILS.

• Risk/commodities: Geopolitical uncertainty is maintaining demand for safe-haven currencies like the USD.

• One macro factor: The Bank of Israel's forecast of 4.7% GDP growth for 2026 signals a recovery that could support the ILS.

Range:

The USD/ILS is expected to drift within its recent 3-month range as both currencies exhibit stable patterns.

What could change it:

• Upside risk: A stronger-than-expected US producer price index could boost the USD.

• Downside risk: Further interest rate cuts by the Bank of Israel could weaken the ILS even more.