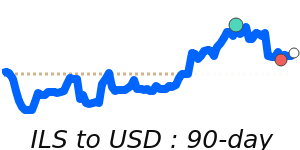

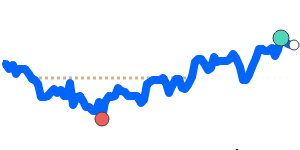

The USD to ILS exchange rate has experienced notable fluctuations in recent months, primarily influenced by geopolitical tensions and economic factors impacting both currencies. Currently, the USD is trading at 3.3311 ILS, reflecting a significant decline of 5.6% from its 3-month average of 3.5278. This period has seen the exchange rate move within a volatile range of 3.3170 to 3.7184, indicating considerable market activity.

Analysts attribute part of the recent strength of the USD to diminishing expectations for Federal Reserve interest rate cuts, combined with positive sentiments surrounding potential trade deals ahead of deadlines. These developments have bolstered safe-haven inflows into the dollar. However, expectations could be tempered if the new trade agreements do not meet market hopes, potentially introducing headwinds for the USD.

On the other hand, the Israeli shekel (ILS) has faced significant challenges, primarily due to political instability and military conflicts in the region. The shekel recently hit its lowest level against the dollar in nearly eight years, heavily influenced by the escalated conflict following the October 7 attack by Hamas. The Bank of Israel's intervention through foreign exchange sales highlights efforts to stabilize the currency amid ongoing uncertainties.

Overall, the future trajectory of the USD to ILS exchange rate will largely depend on geopolitical developments, the Federal Reserve's policy direction, and economic indicators such as inflation and employment figures in the U.S. If Israeli economic stability does not improve or if geopolitical tensions continue, the ILS may struggle against a resilient USD. Investors should remain vigilant and consider these factors when planning international transactions involving the USD and ILS.