The Japanese yen (JPY) remains a focal point in the currency markets, primarily influenced by escalating trade tensions and the Bank of Japan's (BoJ) monetary policies. Recently, the US imposed a 24% tariff on Japanese goods, heightening the impact of the trade war initiated during the Trump administration. This geopolitical backdrop has contributed to a flight to safety, strengthening the yen and the Swiss franc as investors seek refuge amid uncertainty.

Analysts from MUFG Research have projected a USD/JPY exchange rate of 154.00 for Q1 2025, with expectations of a gradual drop to 148.00 by Q4 2025. However, due to recent depreciation against the dollar, a reassessment of these forecasts may be warranted. The yen often acts as a safe-haven asset, gaining traction during periods of global economic distress, but its recent performance showcases the complex interplay of external pressures.

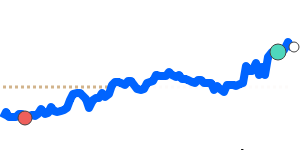

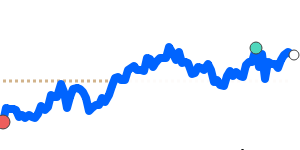

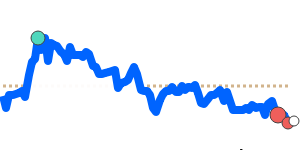

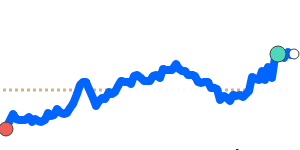

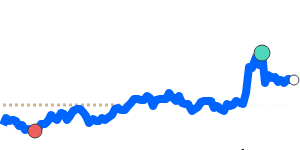

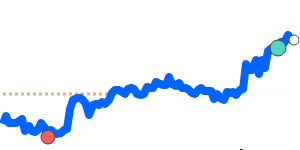

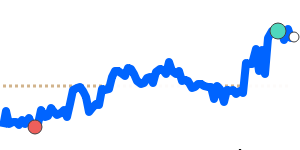

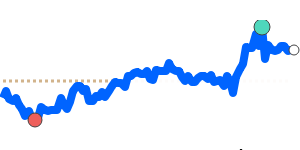

The JPY/USD pair is currently trading at 14-day highs near 0.006958, which is just 0.5% above its three-month average of 0.00692. This stability has seen it trading within a six percent range from 0.006684 to 0.007099. On the other hand, the JPY/EUR exchange rate at 0.005902 is 3.2% below its three-month average, indicating some weakening against the Euro. Similarly, the JPY/GBP rate at 0.005066 stands 2.2% below its three-month average, reflecting a consistent trend of underperformance against the British pound.

The yen's value is intricately linked to Japan's export-driven economy. A weaker yen typically boosts exports by making Japanese goods more competitive globally, while a stronger yen can have the opposite effect. Economic stability in trading partners like the US and China, along with the BoJ's interest rate policies, will continue to shape the outlook for the yen.

As global risk sentiment fluctuates due to geopolitical events, such as the ongoing situation in Ukraine, the yen’s safe-haven role may be further tested. Rising commodity prices and supply chain disruptions pose additional risks to the currency's performance. Overall, market participants should stay alert to changes in BoJ policy and broader global economic developments that could heavily influence the future trajectory of the yen.