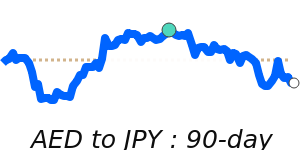

Outlook

BoJ policy normalization is underway, with the rate at 0.5% and more hikes possible if growth strengthens. The narrowing BoJ–Fed yield gap and improving risk appetite weigh on the yen. Political and fiscal jitters around elections keep volatility and the chance of official intervention in play. Markets are pricing a gradual normalization, but data surprises could keep USDJPY range-bound for now. The yen remains sensitive to U.S. rate expectations and any signs of intervention risk.

Key drivers

- BoJ policy shift to 0.5% with potential further hikes

- Fiscal concerns and election-related uncertainty boosting intervention risk

- Global risk appetite improving, reducing safe-haven yen demand

- Narrowing yield differentials reducing carry-trade appeal

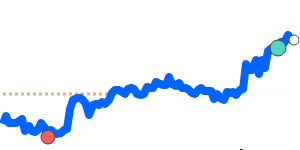

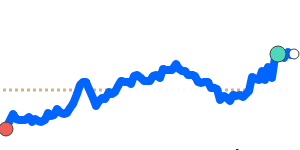

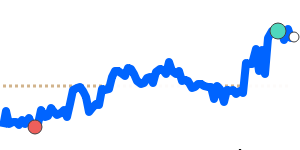

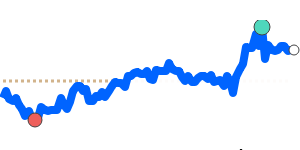

Range

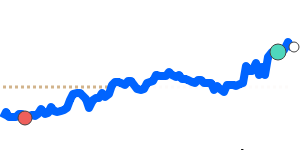

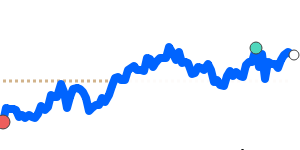

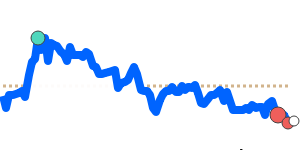

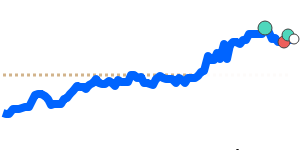

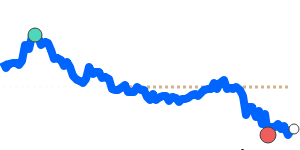

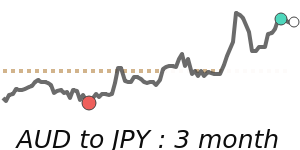

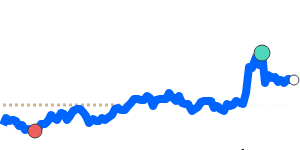

JPY/USD is at 0.006384 near 14-day lows; range 0.006284–0.006566. JPY/EUR at 0.005430; range 0.005370–0.005541. JPY/GBP at 0.004764; range 0.004666–0.004869.

What could change it

- Unexpected BoJ tightening path

- U.S. rate surprises widening the yield gap

- Election outcomes altering policy or intervention risk

- A drop in global risk appetite boosting yen