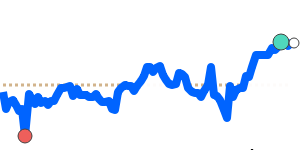

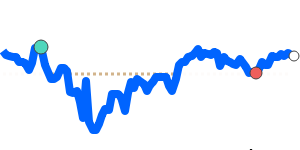

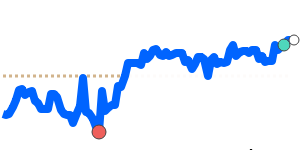

The Mexican peso (MXN) has experienced notable volatility in recent weeks as traders reacted to evolving US trade policies. Analysts observed a decline in the peso against the US dollar following comments from President Claudia Sheinbaum regarding potential retaliatory measures against the US after newly implemented tariffs. This dip pushed the MXN to 7-day lows near 0.053570, which is approximately 3.0% above its 3-month average of 0.05202.

However, the currency showed resilience and rebounded when US Commerce Secretary Howard Lutnick indicated that the current tariffs may not be permanent. The situation has sparked hopes of negotiations between Mexico and the US, leading to a rally in risk-sensitive currencies. Notably, Trump agreed to temporarily delay the 25% tariffs on Mexico for one month, in exchange for Mexico deploying 10,000 troops to the border to combat fentanyl trafficking and manage migration.

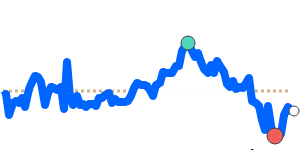

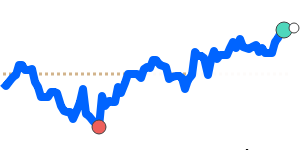

In conjunction with this news, the MXN has displayed some stability against other currencies. The exchange rate for MXN to EUR stands at 0.045865, just 0.9% above its 3-month average of 0.045435, reflecting a steady trading range. The MXN to GBP is currently at 0.039702, which is 2.7% above the 3-month average, while the MXN to JPY rate has seen a more pronounced increase, trading at 7.8880—4.9% above its average.

Overall, the peso is trading within a relatively stable range, signaling that while market participants remain cautious, there is optimism towards a more favorable trade environment. Analysts recommend closely monitoring further developments in US-Mexico relations as they will likely play a significant role in shaping the peso's trajectory in the weeks ahead.