Outlook

Banks see the peso weakening toward the 19 MXN per USD area by year-end, reflecting tariff risks. Banxico left the policy rate at 7% in February, keeping inflation in focus. Nearshoring and rising investment offer some support, but inflation remains above target in the near term. The MXN may stay in a narrow range, with a downside tilt if tariffs persist and price gains stay sticky.

Key drivers

• U.S. 15% import surcharge weighs on MXN.

• Banxico at 7% keeps inflation dynamics in focus.

• Nearshoring and stronger foreign investment provide peso support.

• Core inflation remains above target; a return to 3% is expected by mid-2027.

Range

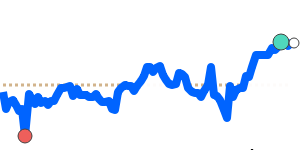

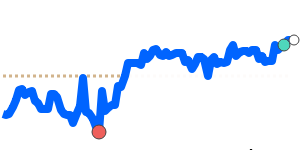

MXN/USD 0.056804; near its 3-month average; range 0.054766–0.058427.

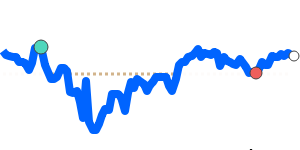

MXN/EUR 0.048833; above its 3-month average; range 0.047057–0.049569.

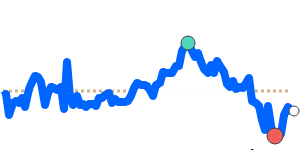

MXN/GBP 0.042502; above its 3-month average; range 0.041100–0.043312.

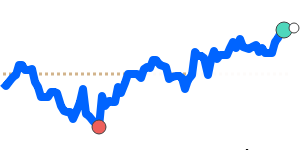

MXN/JPY 8.9175; above its 3-month average; range 8.5065–9.1351.

What could change it

• Tariff policy shifts in the United States.

• Surprise Banxico policy move or faster inflation cooling.

• A sustained rise in nearshoring investment or capital inflows.

• Changes in global risk trends and dollar strength.