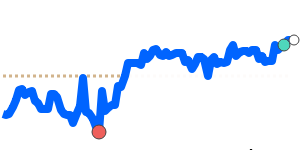

The Mexican peso (MXN) has experienced significant volatility recently, primarily influenced by ongoing trade tensions with the United States. The peso initially weakened against the US dollar following President Claudia Sheinbaum's announcement of potential retaliatory measures in response to tariffs reintroduced by the Trump administration. However, it subsequently rebounded when US Commerce Secretary Howard Lutnick indicated that Trump might consider easing these tariffs, fueling optimism for negotiations between the two nations.

Recent developments show that Trump agreed to delay the imposition of the planned 25% tariffs on Mexico for an additional month after discussions with Sheinbaum. In exchange, Mexico committed to deploying 10,000 troops to its border, aimed at curbing the migration of fentanyl and other migrants into the US. This concession appears to have reassured traders, allowing the peso to lead gains among risk-sensitive currencies.

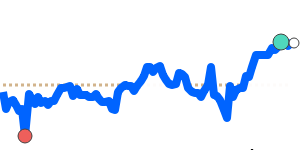

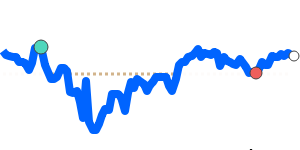

Currently, the MXN to USD exchange rate has reached 90-day highs near 0.053756, representing a 3.6% increase above its three-month average of 0.051881. The peso has fluctuated within a notable 9.3% range during this period, trading between 0.049188 and 0.053756. In relation to the euro, the MXN is at 14-day highs around 0.045937, exceeding its three-month average of 0.045356 by 1.3%. The trading range for this pair has been relatively stable at 6.5%, between 0.043332 and 0.046168.

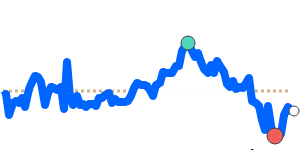

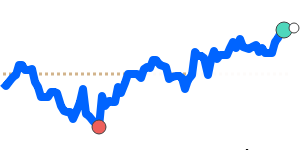

against the British pound, the MXN has also reached 90-day highs near 0.039584, 2.5% above its three-month average of 0.0386, with a more consistent trading range of 5.3% from 0.037593 to 0.039584. Additionally, the MXN to JPY exchange rate currently sits at 7.8640, marking a significant 5.0% rise over the three-month average of 7.4898, although this pair has demonstrated a volatile 11.6% range, from 7.0581 to 7.8781.

Overall, analysts suggest that while the peso encounters short-term fluctuations tied to trade negotiations, a longer-term stabilization may occur if the tariff situation resolves favorably. This evolving landscape provides opportunities for individuals and businesses engaging in international transactions who may benefit from closely monitoring these currency trends.