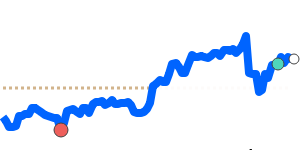

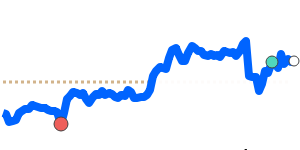

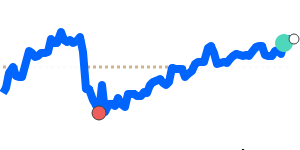

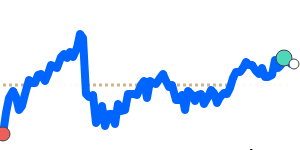

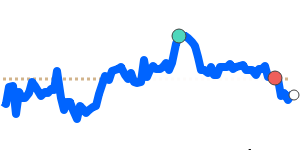

The USD to NOK exchange rate has recently shown increased volatility, influenced by various economic indicators and market sentiments. Currently, the rate hovers near 10.05, which is 2.3% lower than its three-month average of 10.29. Analysts note that the pair has experienced a significant trading range, fluctuating 10.9% from 9.90 to 10.98 over the last few months.

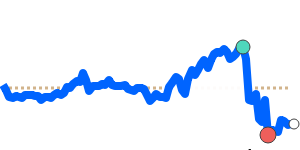

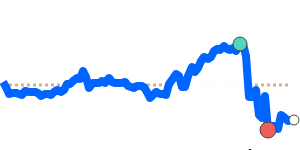

Recent U.S. economic data, particularly the non-farm payroll figures, have bolstered the USD. The addition of 147,000 jobs in June, surpassing forecasts, along with a decrease in the unemployment rate and stronger ISM services PMI, has contributed to the U.S. dollar's strength. These factors indicate resilience in the U.S. economy, which is likely to support the USD against currencies like the NOK.

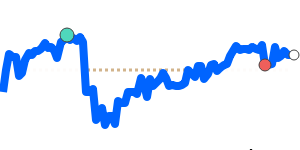

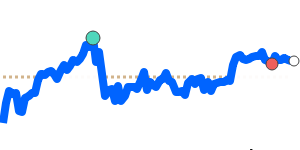

On the other hand, the Norwegian krone has gained approximately 9% year-to-date against the USD, driven by improving European economic sentiment and an inflation surprise in Norway. The Norges Bank remains cautious, with only slight easing expected, which has kept NOK in a strong position. However, some analysts suggest that the EUR/NOK pair could see a rebound in the second quarter, as European sentiment may face hurdles related to U.S. tariffs.

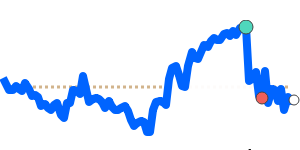

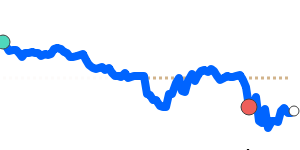

Oil prices, a crucial factor for the NOK, are trading at $68.80, reflecting a 3.2% increase from the three-month average of $66.66, and have shown a considerable volatility of 31.1%, ranging from $60.14 to $78.85. Given Norway's status as a major oil exporter, continued fluctuations in oil prices will likely impact the strength of the NOK against the USD.

Overall, while the USD has strengthened following positive U.S. labor market data, the NOK remains robust, underpinned by favorable domestic conditions and rising oil prices. The interplay of these factors suggests a complex landscape for the USD/NOK exchange rate in the near future, with potential for further volatility as global economic conditions evolve.