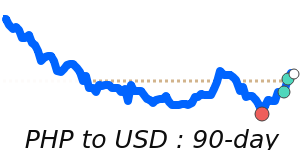

The Philippine peso (PHP) is currently navigating a challenging landscape in the currency markets, influenced by external and internal factors. Recent analysts from ABN Amro have flagged concerns over the peso, suggesting that its overvaluation and weak external balances could lead to depreciation against the US dollar (USD) in 2025. The currency is presently trading at 7-day highs near 0.017681 against the USD, remaining stable within a 4.0% range. Despite this slight strength, it remains 0.5% below its 3-month average of 0.017773.

Further compounding the situational uncertainty, the US government has imposed a 17% reciprocal tariff on Philippine goods as part of ongoing trade tensions under the Trump administration. This move not only adds pressure to the PHP but also raises concerns about the Philippines' trade dynamics and competitiveness, especially since the country has not significantly benefited from regional strategies like "China+1."

Political developments, particularly surrounding the recent arrest of former president Rodrigo Duterte, could inject additional volatility into the financial markets. While mid-term elections typically do not indicate significant policy shifts, the underlying political uncertainty could sway investor sentiment and affect the peso's trajectory.

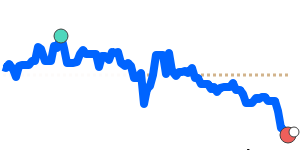

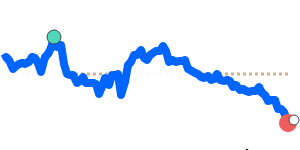

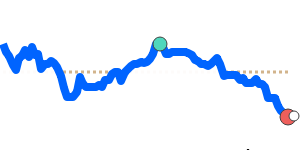

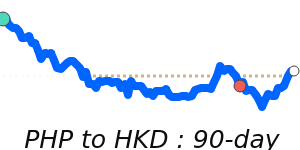

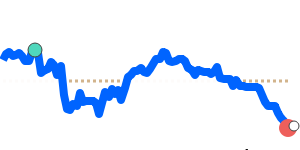

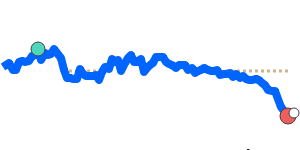

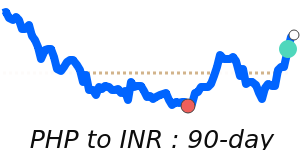

In parallel, the PHP is experiencing stress against other major currencies. It is trading at recent lows against the Euro (EUR) at 0.015077, which is 3.8% below its 3-month average, and also faces pressure against the British pound (GBP) at 0.012888, which is down 3.2% from its average. The PHP has maintained relative stability against the Japanese yen (JPY), trading at 2.5557.

Overall, the outlook for the Philippine peso appears challenging with potential influences from trade tariffs, political uncertainty, and evolving market dynamics as global tension mounts. Businesses and individuals engaging in international transactions should remain vigilant and consider these developments when planning currency exchanges.