Recent developments surrounding the Philippine peso (PHP) suggest a mixed outlook amid a backdrop of external pressures and political uncertainty. The imposition of a 17% reciprocal tariff by the US on Philippine goods is stirring concerns, as analysts suggest this may further weigh on the peso's performance. ABN Amro has indicated that the combination of weaker external balances and an overvalued peso could lead to depreciation against the US dollar (USD) by 2025.

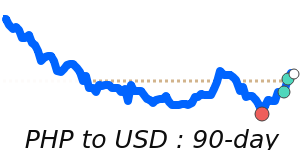

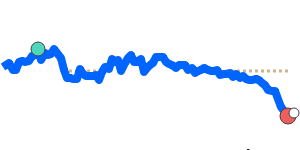

In terms of currency performance, the PHP has shown recent resilience against the USD, with the PHP/USD rate hovering near 7-day highs at 0.017711, only 0.6% shy of its 3-month average. The PHP has maintained a stable trading range of 3.5% over the past weeks, suggesting a degree of steadiness despite the challenging economic backdrop.

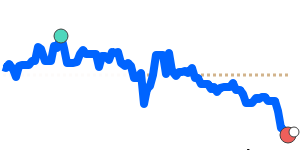

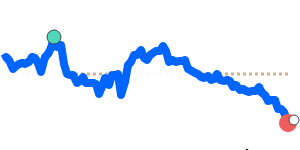

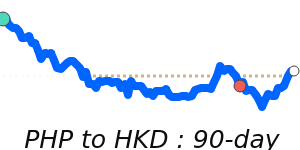

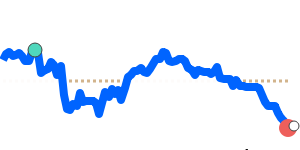

against the Euro (EUR), the PHP is currently trading at 14-day highs near 0.015151, though it remains 2.7% below its 3-month average. The PHP/EUR exchange rate has had a stable trading range of 7.5%. Similarly, the PHP/GBP currency pair is also at 14-day highs, reflecting a consistent trend with a rate of 0.013115, just 1.0% below its 3-month average.

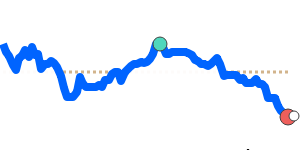

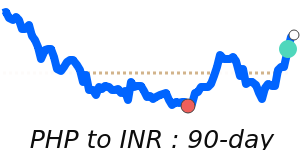

against the Japanese yen (JPY), the PHP has gained strength, reaching 30-day highs near 2.6092, which is 1.5% above its 3-month average. This improvement illustrates the PHP's relative strength within this trading period.

Political developments in the Philippines, including the recent arrest of former president Rodrigo Duterte, have raised concerns over potential political uncertainty leading up to the mid-term elections. While mid-term elections may not typically translate to broad policy changes, increased uncertainty can influence investor sentiment adversely.

The overall outlook for emerging Asian currencies, including the PHP, has deteriorated with recent US tariffs on China, which could curtail expectations for the Philippines' economic performance. Unlike other regional players, the Philippines has not capitalized significantly on supply chain diversification, particularly in the electronics sector, while neighboring countries like Vietnam and India have made notable gains.

In summary, while the PHP has shown short-term resilience in some currency pairs, the broader economic and political context raises caution for future movements. Investors and businesses involved in foreign exchange should remain vigilant as these factors evolve.