The Thai baht (THB) is facing significant pressure as recent developments in the global trade landscape have fueled uncertainty in emerging Asian currencies. Following the imposition of a 36% reciprocal tariff rate by the US on Thai goods, concerns have escalated regarding the potential for a broader trade war under President Trump's administration. This sentiment has contributed to a decline in risk appetite across the region, prompting a drop in several Asian currencies, including the baht, which has slid approximately 2% alongside the South Korean won.

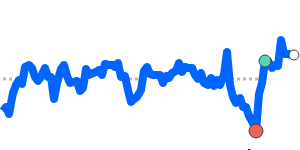

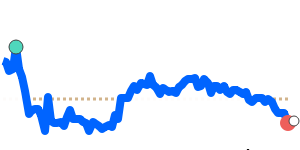

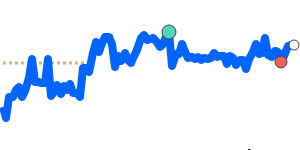

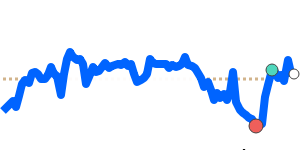

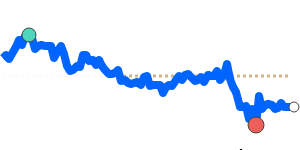

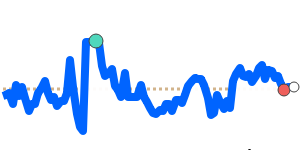

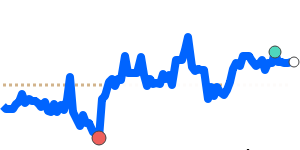

Price data indicates that the THB to USD exchange rate stands at 0.030836, which is 1.8% above its three-month average of 0.030285. The trading range for the THB against the dollar has remained relatively stable, fluctuating between 0.028663 and 0.030930 over the past three months. Conversely, the THB to EUR has dipped to 0.026202, now 1.5% below its three-month average of 0.026609, with a tighter trading range observed between 0.026099 and 0.027107. For THB to GBP, the rate is currently at 0.022566, just below its three-month average, maintaining a narrow range from 0.022275 to 0.022917.

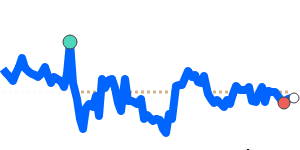

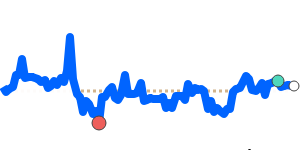

The THB to JPY has shown some resilience, trading at 4.4619, which is 2.0% above its three-month average of 4.3729. This currency pair has traded within a relatively stable range of 4.1930 to 4.4665, indicating some degree of strength against the yen amidst the turbulent backdrop of trade tensions.

Overall, experts project ongoing volatility for the Thai baht, influenced by external factors such as global trade developments and regional monetary policy adjustments. With central banks in Asia, including Thailand, increasingly considering interest rate cuts to support growth, market participants should brace for continued fluctuations in THB exchange rates.