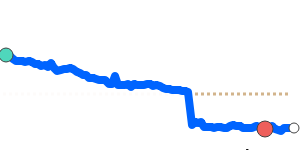

USD/TRY Outlook:

The USD/TRY rate is likely to increase as it is trading significantly above its recent average and near recent highs. Factors supporting this include geopolitical tensions that drive demand for safe-haven currencies like the USD.

Key drivers:

- Rate gap: The Federal Reserve's interest rate adjustments continue to attract global capital, enhancing USD strength compared to the depreciation pressures on the Turkish Lira.

- Risk/commodities: Current geopolitical uncertainty keeps the USD strong as investors seek safe-haven assets.

- One macro factor: The Turkish government's end of the Currency Protected Deposit Scheme reflects a shift towards more market-driven influences on the Lira.

Range:

The USD/TRY is likely to hold near the higher end of its recent 3-month range, influenced by ongoing geopolitical risks.

What could change it:

- Upside risk: An unexpected increase in US economic indicators could further boost the dollar.

- Downside risk: A significant improvement in Turkish economic stability could provide support to the Lira.