Outlook

The CAD is likely to hover around the mid-0.70s per USD, supported by firmer oil but tempered by U.S.-Canada trade tensions and the BoC-Fed policy gap. If January retail sales show a pickup, the loonie could edge higher; otherwise, expect continued range trading near current levels.

Key drivers

- Oil price: Oil sits near 90-day highs at about 71.32 USD, well above the 3-month average (64.14). As a commodity-linked currency, the CAD tends to strengthen with higher oil prices.

- Domestic data: January retail sales figures could provide a near-term lift for the CAD if consumer spending. A positive print may add modest upside to the pair.

- Monetary policy divergence: The Fed’s easing path versus the BoC’s cautious stance creates cross-currents for USD/CAD, potentially limiting sharp moves but keeping the pair in a range.

- Trade developments: Historical U.S. tariffs on Canadian goods and ongoing trade tensions add risk to CAD, particularly on headlines and policy shifts.

- Commodity volatility: Broader swings in commodity markets continue to influence the CAD beyond oil alone.

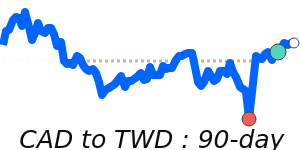

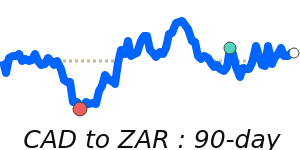

Range

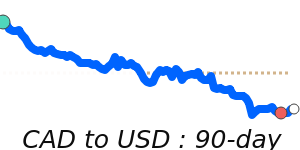

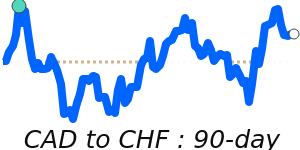

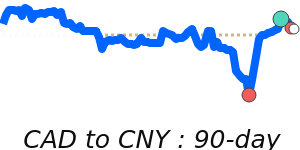

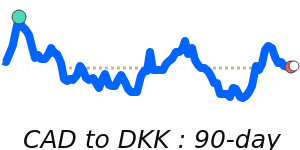

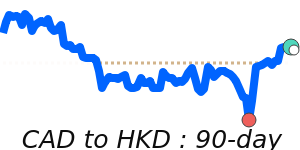

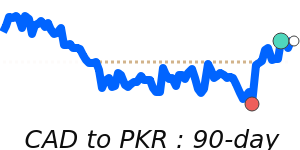

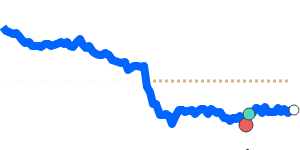

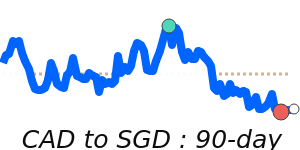

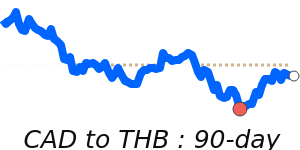

- CAD/USD: current 0.7305; range 0.7087–0.7413

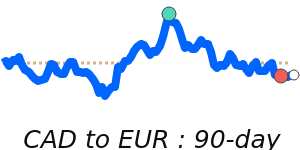

- CAD/EUR: current 0.6208; range 0.6120–0.6217

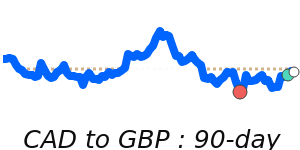

- CAD/GBP: current 0.5428; range 0.5322–0.5434

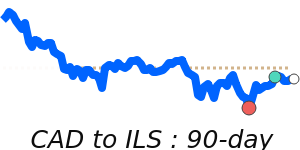

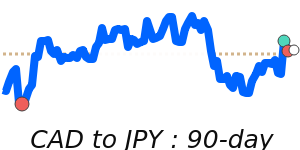

- CAD/JPY: current 113.3; range 110.7–115.3

- Oil (USD): current 71.32; range 59.04–71.32

What could change it

- Oil price trend: A sustained move above current levels could help the CAD; a sharp pullback would weigh on it.

- BoC policy path: Surprise rate moves or communications altering the rate outlook could shift CAD sentiment.

- Fed policy trajectory: Further widening or narrowing in the policy gap between the Fed and BoC would push USD/CAD in either direction.

- Trade developments: New tariffs, trade talks progress, or policy changes between the U.S. and Canada could drive sharper CAD moves.

- Domestic data surprises: Strong January retail sales or other positive Canadian data could provide a near-term lift to the loonie.