The Canadian dollar (CAD) has recently found some support, largely buoyed by a stronger US dollar. However, its correlation with oil prices remains critical. Weakening oil prices have limited the gains of the crude-linked 'loonie,' which underscores the currency's significant connection to commodity markets. Current oil prices are trading at $68.80, approximately 3.2% above the three-month average of $66.66, although they have shown considerable volatility within a range of $60.14 to $78.85.

Market analysts are closely watching upcoming data, including Canada’s June services PMI. A contraction in this sector could lead to additional pressure on the CAD, complicating its recovery. Recent political developments, notably the shift in leadership following Prime Minister Justin Trudeau's resignation, have potentially cast a shadow over investor confidence. The appointment of Mark Carney as Prime Minister comes during a time when ongoing trade tensions—specifically the imposition of tariffs by the U.S. on Canadian goods—remain a persistent concern.

Despite these headwinds, the Bank of Canada's decision to pause interest rate cuts in April has provided a measure of support for the CAD. The current benchmark rate is held steady at 2.75%, a move that some economists believe could help stabilize the currency in the face of fluctuating market conditions.

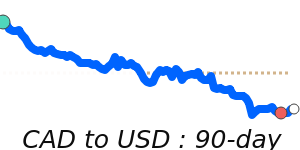

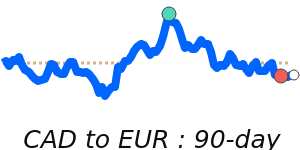

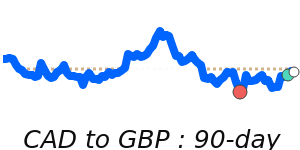

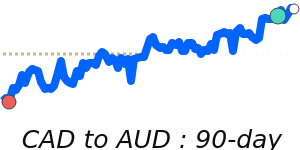

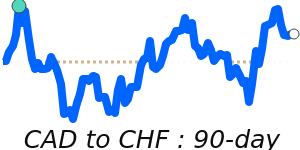

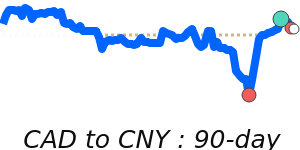

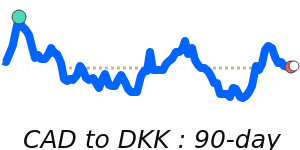

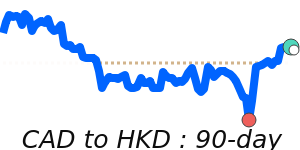

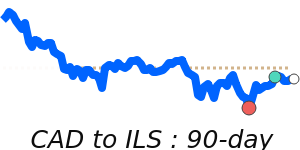

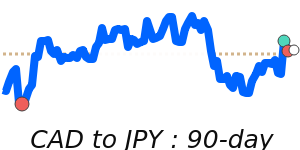

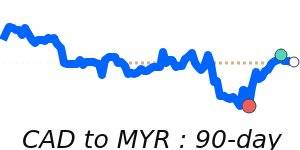

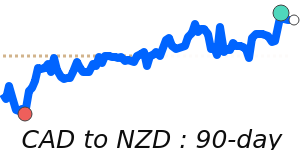

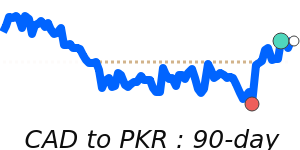

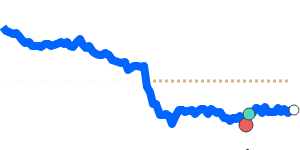

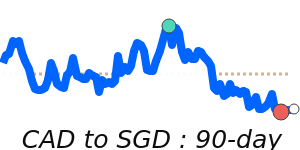

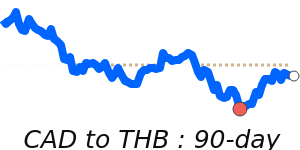

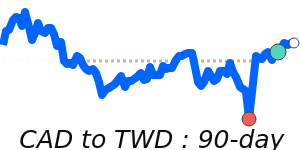

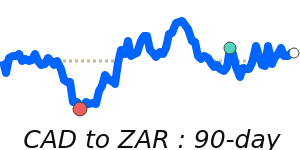

The CAD has shown recent strength in its performance against the dollar, with rates reaching 90-day highs near 0.7369, significantly above its three-month average of 0.7241. Conversely, trading against the Euro at 0.6259 reveals it is 1.6% below its three-month average, hinting at a mixed outlook compared to other currencies. The CAD to GBP rate is performing just below the three-month average, while it maintains a favorable trend against the JPY, hitting 106.7 and exceeding its average by 2.0%, indicative of its recent stability.

Going forward, the Canadian dollar’s trajectory will likely depend on the interplay of oil market trends, updates from the Bank of Canada, and shifts in the U.S. economy and trade relations. As global economic uncertainties persist, analysts caution that the potential for CAD appreciation may be limited by the ongoing tariff threats and the evolving economic landscape.