DKK & NOK - Markets & outlook

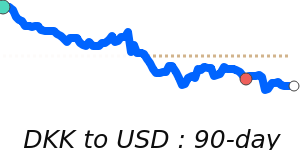

Danish krone - DKK:

Danish krone - DKK:

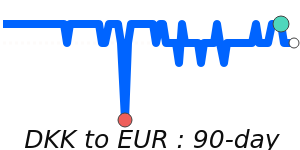

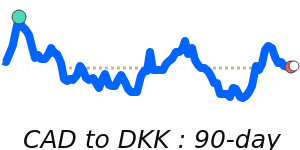

The Danish kroner (DKK) is fixed to the Euro so the EURDKK exchange rate should not fluctuate very much. The fixed exchange rate policy provides Danish businesses and consumers with greater stability and predictability in their financial transactions, particularly those involving international trade and investment. It reduces the risks associated with fluctuations in currency values, which can be particularly important for small, export-oriented economies like Denmark. However, the policy also limits the flexibility of the Danish central bank to adjust interest rates or implement other monetary policies in response to changing economic conditions, as it must maintain the exchange rate within the agreed-upon range. In recent years, Denmark has faced challenges in maintaining the fixed exchange rate policy, particularly in the face of currency fluctuations and changes in interest rates in other countries, which have required the DNB to intervene frequently in currency markets.

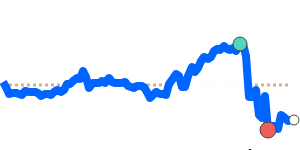

Norwegian krone - NOK:

Norwegian krone - NOK:

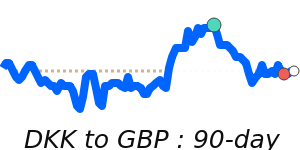

NOK has rocketed higher in the past few weeks, currently up 9% year-to-date versus the dollar. That is largely due to a boost in European economic and equity sentiment, but the inflation surprise in Norway played a key role. Markets are pricing in only 8bp of easing for 27 March and only one cut in the next 12 months.

ABN-Amro's fair value model shows EUR/NOK is undervalued relative to short-term drivers, embedding an excess of optimism relative to European spending optimism and rotation from US equities back to Europe.

So, while EUR/NOK could remain pressured this week after a Norges Bank hold, ABN-Amro are less optimistic about further gains and actually see room for a EUR/NOK rebound to 11.50 in the second quarter, when US tariffs may materially temper European sentiment.