Currency in Denmark: DKK Send & Spend FX Guide

Resources for Expats, Travelers and Entrepreneurs Navigating Life and Trade in Denmark with the Danish krone.

Resources for Expats, Travelers and Entrepreneurs Navigating Life and Trade in Denmark with the Danish krone.

What's in this Denmark currency guide?

What currency is used in Denmark?

The official currency of Denmark (country code: DK) is the Danish krone, with symbol kr and currency code DKK.

What is a good Danish krone exchange rate?

The BestExchangeRates.com currency comparison table below helps you see the total cost of your currency transaction by showing the exchange rates offered by different providers. It also makes it easy to spot potential savings from market-leading FX services compared to bank rates.

To see a full list of rates, enter your transaction type, currencies and amount then click ‘GET RATES’:

Loading rates...

|

|

|

Good things to know about the Danish krone

Recent headlines about the US's interest in Greenland, including potential military action, have not significantly impacted markets. This reflects the market's hesitation to price in Trump's geopolitical moves.

However, US-Denmark tensions have highlighted the Danish krone as a potential indicator of Greenland-related risks. January has seen unusual EUR/DKK forward movements and slight upward pressure on spot rates. These shifts may involve central bank intervention and speculation about Greenland but are not alarming yet.

Denmark's Stakes

Greenland, an autonomous Danish territory, contributes little to Denmark's GDP (0.8% if included, mainly from fisheries). Denmark provides Greenland with an annual grant of DKK 3.9bn (US$511m), which is 20% of Greenland’s GDP and over half its government revenue.

Economic risks for Denmark from US claims on Greenland are indirect. Excluding the unlikely scenario of military conflict, economic retaliation is the main concern. The US, Denmark's largest export market (18% of exports, mainly pharmaceuticals), has already targeted Danish products with protectionist policies.

Denmark maintains a fixed exchange rate policy ("peg") to stabilize the Danish krone against the euro at around 7.46 DKK per euro. The Danish National Bank enforces this policy to ensure economic and financial stability.

For more DKK information check out our selection of Danish krone news and guides.

Frequently Asked Questions

What currency should I use in Denmark?

The domestic currency in Denmark is the Danish krone.

What is the Danish krone currency code and symbol?

The three letter currency code for the Danish krone is DKK — symbol is kr.

What does the Danish krone look like?

Here is an example Danish krone banknote:

Which countries use the Danish krone?

It is the domestic currency in Denmark, Faroe Islands and Greenland.

Is the Danish krone a closed currency?

No, the Danish krone is freely available and convertible. See guide: What is a closed currency?

What are equivalent amounts of USD and DKK?

Here are some popular conversion amounts for USD to DKK (US dollar to Danish krone)*.

*Converted at the current USDDKK interbank exchange rate. Calculate actual payout amounts for Send Money and Travel Money exchange rates.

Travel money for Denmark

Using Wise for Danish krone travel money is a smart choice for savvy travelers. With its competitive exchange rates and low fees, Wise allows you to convert and manage multiple currencies effortlessly.

Be careful when using your own bank's Debit/Credit Card, as your bank may also charge an extra 3% as an “Overseas Transaction Charge” plus “Overseas ATM” fees for withdrawing cash on top of the standard Visa/Mastercard 2.5% from market mid-rate.

For card purchases, if you are offered a choice of currencies always select to Pay in Danish krone otherwise you will typically get much worst dynamic currency conversion (DCC) exchange rates.

If you really want Danish krone cash before departure, you can save money by ordering online. You generally get better rates and can pick up the DKK cash locally or even on travel day at the airport.

Denmark: Travel Guide

Traveling to Denmark requires careful financial planning to ensure a smooth and cost-effective experience. Here's a comprehensive guide to help you navigate currency considerations and manage your money effectively during your visit.

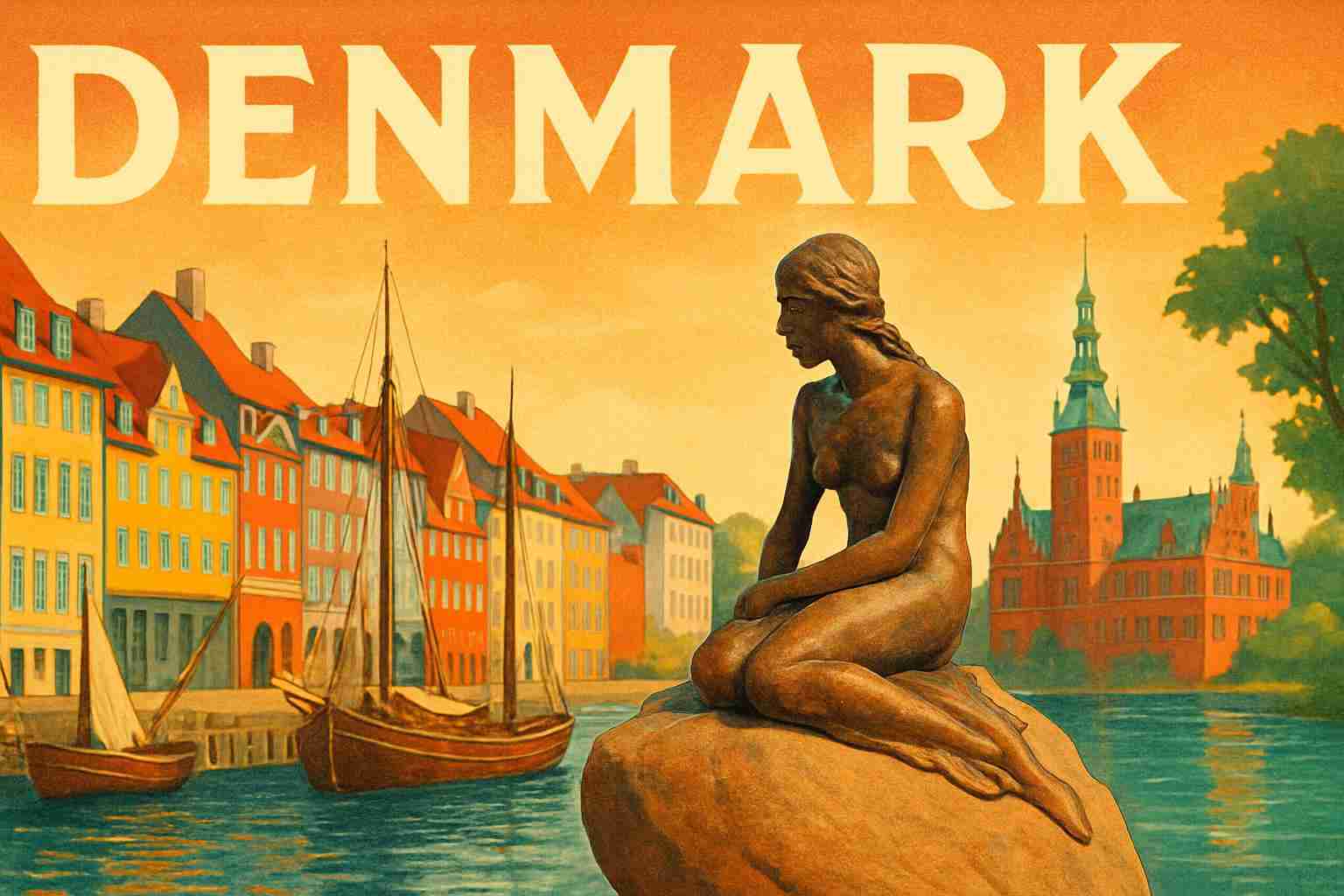

Denmark is a country located in Northern Europe, known for its picturesque landscapes, historic cities, and vibrant culture. The country is made up of the peninsula of Jutland and a large number of islands, including the main islands of Zealand, Funen, and Bornholm. The capital and largest city is Copenhagen, and the official language is Danish. Denmark has a constitutional monarchy form of government and is a member of the European Union.

For travelers, Denmark is known for its picturesque landscapes and historic cities, including:

- Copenhagen: The capital city is known for its vibrant cultural scene, historic architecture, and famous landmarks such as Tivoli Gardens, the Little Mermaid statue, and Amalienborg Palace.

- The Viking Ship Museum: Roskilde, it's a must-see for anyone interested in Viking history, where you can see five original Viking ships from the 11th century.

- The Legoland Billund: It's a popular theme park for families, it's the original Legoland park, and it's the most popular tourist attraction in Denmark.

- The Ring of Jutland: it's a scenic drive that takes you through charming villages, picturesque landscapes and along the beautiful Danish west coast.

- Odense: The birthplace of Hans Christian Andersen, the city offers visitors the opportunity to explore the writer's legacy, as well as a beautiful Old Town.

- Ribe: It's the oldest surviving town in Denmark, known for its well-preserved medieval architecture, charming cobblestone streets, and picturesque setting.

Is the Euro accepted in Denmark?

Denmark does not currently use the euro as its currency and has no plans to replace the krona in the near future. This is the same situation in all the Scandinavian countries - Norway, Sweden and Iceland. You may find some shops that will accept the Euro but watch out for the EUR/DKK exchange rates they offer.

Everyday Costs in in Denmark

How much does it really cost to live, work, or travel in Denmark? Here's what to expect for daily expenses and expat living.

For Travelers

Planning a trip to Denmark, known by the ISO code DK, involves budgeting appropriately for a comfortable experience in this Scandinavian country. For a 1-week mid-range stay, travelers should consider bringing around 7,000 to 10,000 DKK. This estimate covers daily expenses, including a meal at a local restaurant averaging 150 DKK, a cup of coffee at 35 DKK, and a single public transport ticket costing 24 DKK. A prepaid SIM card with basic data can cost approximately 100 DKK, while accommodation in a budget hotel or Airbnb typically ranges from 700 to 1,200 DKK per night. Denmark tends to be on the more expensive side compared to other destinations, especially when compared to the United States. In terms of dining and accommodation, Denmark is generally pricier than the U.S., and the cost of living is comparable to that in the United Kingdom or Australia, though slightly less than in Singapore.

For Expats

For those considering a longer stay, Denmark offers a blend of high living standards and modern amenities. Expats can expect typical monthly living costs to range from 12,000 to 25,000 DKK, depending heavily on lifestyle and family size. Renting an apartment in the city center can be costly, around 8,000 to 12,000 DKK per month, whereas utilities and groceries might total approximately 2,500 DKK. Banking in Denmark is straightforward, with easy access to ATMs and wide acceptance of international cards. However, it's advisable to have a local bank account, especially for various daily transactions and receiving salaries. For sending or receiving money, online transfer services like Wise or OFX are highly efficient and often more economical than traditional banks. Exchanging money locally can incur additional costs, so using these services or withdrawing cash from ATMs directly is usually preferable.

USD/DKK Market Data

The below interactive chart displays the USD/DKK change and UP📈 DOWN📉 trends over the past 1 Year.

Recent Danish krone Market News

February 24, 2026

Key Developments Affecting the Danish Krone (DKK):

1. Stable Exchange Rate Policy: Denmark continues to maintain its fixed exchange rate policy, keeping the krone pegged to the euro within a narrow fluctuation band of ±2.25%. (imf.org)

2. Central Bank's Non-Intervention Stance: Despite recent fluctuations, Danmarks Nationalbank has refrained from intervening in the foreign exchange market, indicating confidence in the krone's stability. (fxstreet.com)

3. Increased Trading Volume: Trading in Danish kroner has risen by over 20% globally in the past three years, with domestic trading volumes increasing by approximately 70%, reflecting growing confidence in the currency. (nationalbanken.dk)

4. Integration into European Payment Systems: As of April 2025, the Danish krone is fully integrated into the Eurosystem's T2 and TIPS services, enhancing its role in European financial markets. (ecb.europa.eu)

These developments underscore Denmark's commitment to maintaining the stability and international integration of the Danish krone.

For more DKK information read our News and guides to the Danish krone.

Send Money to Denmark - Best Rates

To get a good (and fair) exchange rate when sending money to Denmark you need to find and compare exchange rates for International Money Transfers (IMTs).

The available FX rates for sending money abroad can be very different to the mid-market (wholesale) rate which you see reported online and in the News.

You should especially compare your own bank's exchange rates to those available from Money Transfer specialists to see how much you can save - we make that calculation easy in the below table.

Get a better deal for foreign transfers to Denmark

When sending money to Denmark it’s important to compare your bank’s rates & fees with those we have negotiated with our partner money transfer providers. To get a better deal you should follow these 4 simple steps :

- Open an account with a BER reviewed FX provider (id docs may be required)

- You specify the local or Danish krone amount you want to transfer

- Make a local currency domestic transfer for the requested amount to the provider's bank account in your country

- Once your funds are received by the provider the converted DKK amount will be transfered to the recipient account you specify in Denmark.

Use the above calculator to compare the exchange rates of FX specialist providers rates versus your bank's standard rates you can hopefully save around 5% and maybe more - end result is more Danish krone deposited into the recipient bank account and less margins and fees kept by the banks!

Managing money while living and working in Denmark

Managing your money effectively while living and working abroad can be challenging, but there are several steps you can take to ensure that your finances are in order.

Understand Danish krone currency exchange rates: Exchange rates can have a big impact on your finances, so it is important to keep an eye on the DKK exchange rate and consider using a money transfer specialist or a credit card that does not charge foreign transaction fees to get the best exchange rate.

Use a local Danish krone bank account: A local DKK bank account can make it easier for you to manage your finances and pay bills while you are in Denmark. It may also be more convenient to use a local DKK bank account to make purchases and withdraw cash.

Research local laws and regulations: It is important to understand the local laws and regulations that apply to financial transactions in Denmark. This can help you avoid legal issues and ensure that you are complying with local requirements.

Consider the tax implications: It is important to understand the tax implications of living or doing business in Denmark. This can help you plan your finances and ensure that you are paying the correct amount of tax.

Seek financial advice: If you are unsure of how to manage your finances in Denmark, it is a good idea to seek the advice of a financial professional who is familiar with the local financial system. This can help you make informed decisions and avoid financial pitfalls.

We have put together some key points to help managing your money effectively, you can reduce financial stress and enjoy your experience living or doing business in Denmark.

Expat life in Denmark

For expats, Denmark is known for its high standard of living, excellent healthcare and education system, and strong economy. The country is also home to a diverse expat community, and major cities like Copenhagen and Aarhus offer a vibrant international community. However, the cost of living in Denmark can be relatively high, especially in major cities like Copenhagen. The weather in Denmark can be quite cold in the winter and quite cool in the summer with the occasional periods of rain throughout the year.

The language might be a barrier for some expats, as Danish is not widely spoken as a second language. However, in major cities like Copenhagen, most people do speak English fluently, and most official forms, documents and customer services are available in English.

Cost of living in Denmark

The cost of living in Denmark is generally considered to be high compared to many other countries. Denmark has a high standard of living and a high per capita income, and this has led to high prices for goods and services in the country. However, the cost of living in Denmark can vary depending on a number of factors, including your personal expenses, the area in which you live, and your lifestyle.

Some things that may be more expensive in Denmark include housing, transportation, and food. However, there are also many things that are less expensive in Denmark, such as clothing and entertainment. Overall, the cost of living in Denmark is similar to that of other Scandinavian countries, such as Sweden and Norway.

It is worth noting that the cost of living in Denmark can vary significantly depending on the region. For example, the cost of living in Denmark's capital city, Copenhagen, is generally higher than in other parts of the country due to higher housing costs.