JPY & THB - Markets & outlook

Japanese yen - JPY:

Japanese yen - JPY:

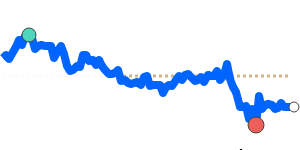

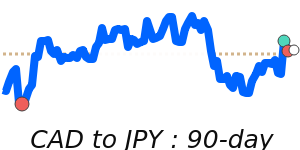

The Japanese yen (JPY) is a major global currency and a safe-haven asset, appreciating during global economic uncertainty. Its value is influenced by Japan's monetary policy, economic performance, global risk sentiment, and trade flows.

Unlike commodity currencies like the Australian dollar (AUD) or Canadian dollar (CAD), the yen is shaped by the Bank of Japan (BoJ) and its interest rate policies. Japan's ultra-low or negative interest rates stimulate growth and prevent deflation, making the yen a popular funding currency for carry trades. When markets are stable, demand for the yen weakens as traders seek riskier assets. In economic stress, investors unwind carry trades, strengthening the yen.

Japan's export-driven economy also affects the yen. A weaker yen benefits exports by making goods cheaper globally, while a stronger yen can hurt exports by making products more expensive. The yen's value is tied to trade balances, manufacturing performance, and demand from key partners like the US and China.

The JPY/USD pair is highly liquid, and the US dollar impacts the yen's exchange rate. A stronger USD weakens the yen, while a weaker dollar supports JPY appreciation. Japanese authorities may intervene in forex markets to prevent excessive yen appreciation, as seen in past interventions.

Geopolitical tensions, like the Ukraine war, have impacted the yen's safe-haven role. Uncertainty in Eastern Europe has led investors to shift funds into the yen, supporting its value. Japan's reliance on imported energy makes the yen vulnerable to rising commodity prices and supply chain disruptions.

The yen's future performance depends on BoJ policy, global risk sentiment, trade relations, and geopolitical developments. A shift from low interest rates could strengthen the yen, while continued loose monetary policy may keep it weak against higher-yielding currencies.

Thai baht - THB:

Thai baht - THB:

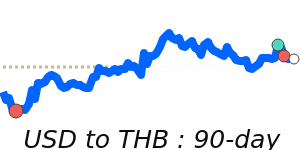

The US imposed a 36% reciprocal tariff rate on goods from Thailand as part of Trump’s growing trade war with countries around the world.

The outlook for emerging Asian currencies is worsening again after US President Donald Trump announced new tariffs on China, curbing optimism that his threats were mainly bargaining ploys.

Regional currencies have tumbled over the past week, with the Thai baht and South Korean won both sliding about 2%, as rising fears over a global trade war sapped risk appetite. Asian currencies have also unwound part of their January rally as a number of central banks in the region cut interest rates to support growth.