CIMB Bank FX at a glance

CIMB Bank, also known as CIMB Group Holdings Berhad, is a leading financial institution based in Malaysia. It is one of the largest banks in Southeast Asia and operates across various countries in the region.

CIMB Bank was established in 1924 as the United Asian Bank and went through several mergers and acquisitions over the years. In 2005, it merged with Commerce International Merchant Bankers (CIMB) to form CIMB Group Holdings Berhad, the parent company of CIMB Bank.

CIMB Bank operates in multiple countries, including Malaysia, Indonesia, Thailand, Singapore, Cambodia, and Vietnam. It has a strong regional presence and provides banking services to individuals, businesses, and corporations.

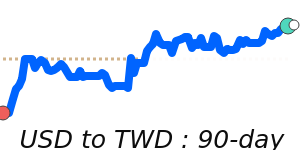

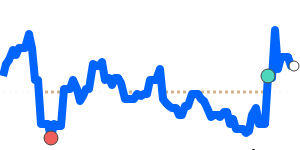

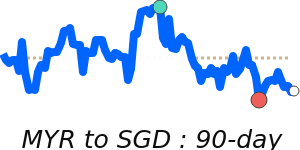

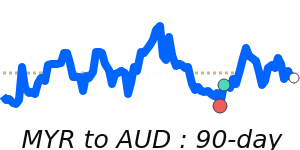

How do CIMB Bank transfer exchange rates compare?

Sending or receiving international transfers to or from your CIMB Bank account will include a margin rate of between 3.5% to 8% – this is much higher than most money transfer broker rates (which are normally 0.5 to 1.5%).

In addition to the exchange rate margin CIMB charge a fixed fee that will vary according to the product and the currencies involved, here is a table with a sample:

| Products/Items |

Charges |

| Branch |

Singapore Dollar

Indonesian Rupiah

All other currencies

|

| CIMB Clicks (Online) |

RM10.00

RM20.00

RM30.00

|

| SpeedSend - RM250 to RM50,000 (limit of up to RM50,000 per customer per day for all payment purposes) |

RM10.00 / transaction |

| Inward Telegraphic Transfer/RENTAS from other banks for Credit to CIMB Account. |

No charge |

| Inward Telegraphic Transfer from Foreign Banks or Nostro Account Statements for Credit to CIMB Account. |

RM5.00 |

| Inward Telegraphic Transfer for Credit to Other Bank Customer's Account via Banker's Cheque. |

RM5.15 (Inclusive stamp duty) |

| Inward Telegraphic Transfer for Credit to Other Bank Customer's Account via RENTAS. |

RM9.00 |

CIMB Bank offers various products that involve foreign exchange (FX) transactions and may charge FX margins and fees. Here are some of the products where FX these costs may apply:

International Wire Transfers: When sending or receiving international wire transfers through CIMB Bank, FX fees may be imposed. These fees are generally charged for converting funds between different currencies and may vary depending on the transfer amount and destination currency.

Credit Cards: CIMB Bank provides credit cards that can be used for international transactions. When making purchases or cash withdrawals in a currency different from the card's billing currency, a foreign transaction fee may be applied. This fee is typically a percentage of the transaction amount and is charged to cover the currency conversion costs.

Debit Cards: Similar to credit cards, CIMB Bank's debit cards can be used for international transactions. When using a debit card for purchases or cash withdrawals in a foreign currency, a foreign transaction fee may be charged.

Overseas ATM Withdrawals: If you use a CIMB Bank card to withdraw cash from ATMs located abroad, an FX fee may be applied. This fee covers the currency conversion costs associated with converting the withdrawn amount into the card's billing currency.

When sending money abroad, CIMB Bank allows you to request a real-time FX rate request, prior to scheduling an international wire. So you can check the rate and compare to the best rates from our BER partner brokers to check for a better deal.