PHP & INR - Markets & outlook

Philippine peso - PHP:

Philippine peso - PHP:

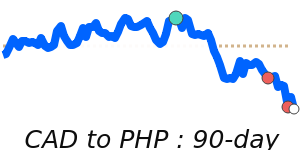

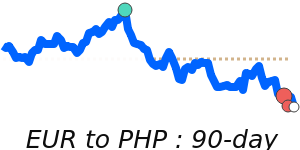

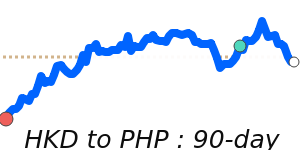

The US imposed a 17% reciprocal tariff rate on goods from the Philippines as part of Trump’s growing trade war with countries around the world.

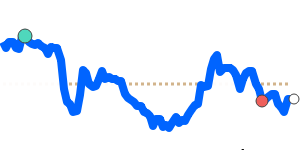

Has USD/PHP peaked?

ABN Amro believe the weaker external balances and an overvalued peso indicate that the Philippine peso is likely to depreciate against the USD in 2025.

What are the implications of the upcoming mid-term elections for markets?

The recent arrest of former president Rodrigo Duterte for alleged crimes against humanity has sparked concerns about its potential impact on the upcoming mid-term elections in the Philippines. While mid-term elections typically do not signify major policy shifts, this development could heighten political uncertainty.

The outlook for emerging Asian currencies is worsening again after US President Donald Trump announced new tariffs on China, curbing optimism that his threats were mainly bargaining ploys.

Unlike some of its Asian peers, the Philippines has not significantly benefited from supply chain diversification and the China+1 strategy, particularly in the electronics sector, where countries like Vietnam, India, and Malaysia have gained global export market share.

Indian rupee - INR:

Indian rupee - INR:

The Indian rupee has steadily weakened (like most currencies) against the US dollar on fears that surging energy prices could spur inflation and interest rate hikes.

India is the third-largest oil-consuming country, after the U.S. and China.

India imports most of its oil requirements and higher crude prices tend to push up domestic inflation.

Investors are shedding Asian currencies including the Indian rupee as the dollar surges against major counterparts, driven by expectations that Trump’s anticipated policies—lower corporate taxes and deregulation—will stimulate U.S. growth.

Additionally, Asian currencies face the potential impact of Trump increasing tariffs, particularly targeting China. This combination is expected to bring a phase of heightened uncertainty and volatility for Asian currencies, with bankers noting that even the typically stable Indian rupee will feel the effects of the disruptions Trump’s policies may introduce.