Money Saving Checklist for Studying Overseas

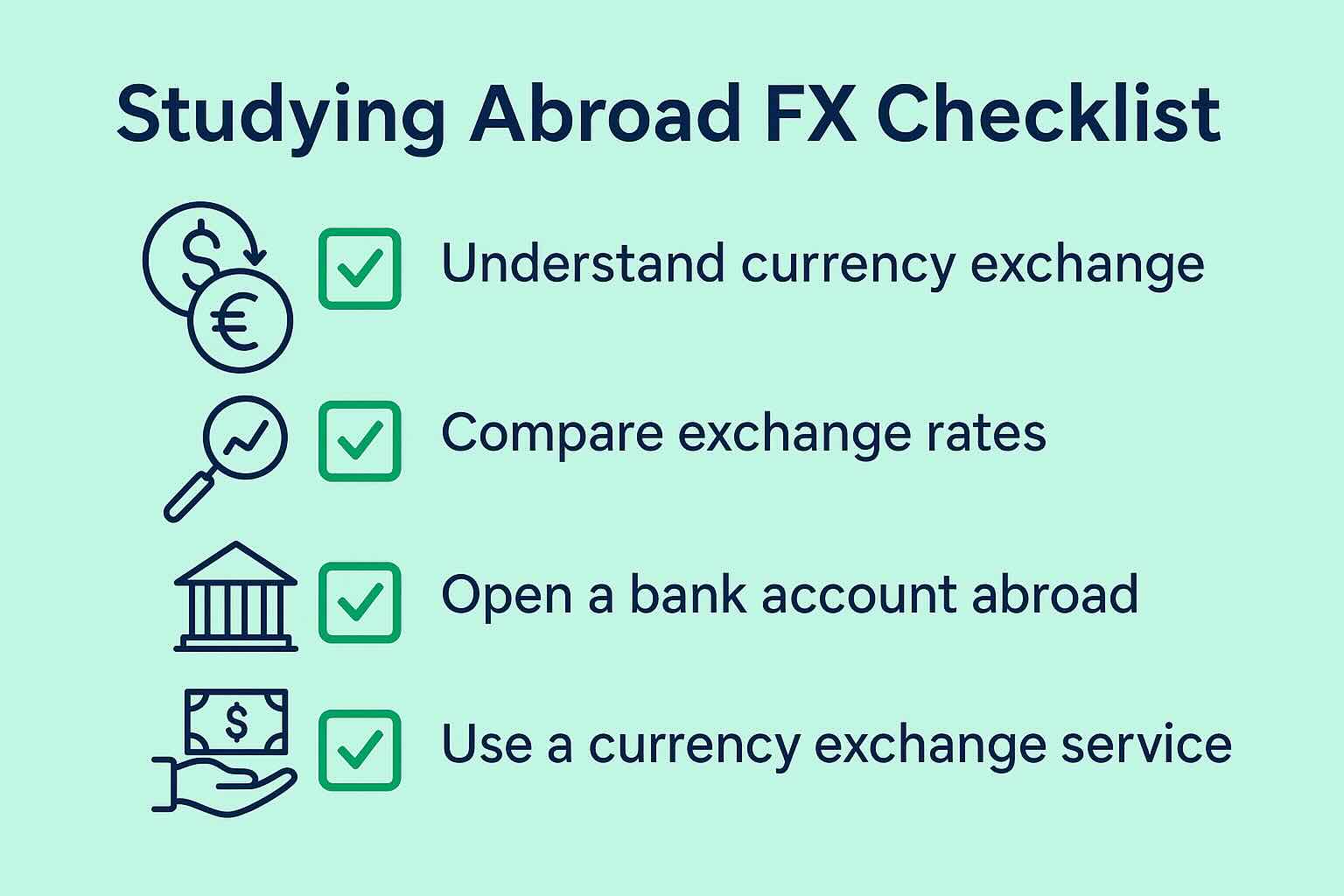

🎓 Studying Abroad: Foreign Exchange Checklist

So you've enjoyed the excitement and celebrations for being accepted into an institution overseas to study, now,down to the logistics. What do you need to have in place to ensure that the transition to student life overseas goes as smooth as possible whilst also making sure that you're being money smart? Here are BER’s top tips...

✔ Before You Leave

1. Compare Money Transfer Providers

Use platforms like BestExchangeRates.com to find the best exchange rates and lowest transfer fees (e.g., Wise, OFX, XE).

2. Open a Multi-Currency Account

Consider opening an account (e.g., Wise or Revolut) that lets you hold and exchange currencies at near mid-market rates.

3. Avoid Airport Exchanges

Exchange a small amount in advance. Airport kiosks are convenient but often offer poor rates.

4. Research Your Destination’s Banking System

• Will you need a local account?

• Are international cards widely accepted?

• Are there ATM withdrawal limits or fees?

⸻

✔ While Studying

3. Use a Travel-Friendly Debit Card

Choose a card with no foreign transaction fees and good exchange rates (e.g., Wise card, Revolut, or a student travel card).

4. Split Payments Over Time (if needed)

If your currency weakens suddenly, consider breaking tuition or rent transfers into smaller parts based on FX trends.

5. Set FX Rate Alerts

Use tools like the BER Rate Tracker to get notified when your home currency strengthens.

6. Pay in Local Currency

Always choose to be charged in the local currency, not your home currency, to avoid hidden “Dynamic Currency Conversion” fees.

⸻

✔ For Parents / Supporters

7. Schedule Regular Transfers Smartly

Plan tuition or living allowance transfers during favorable FX conditions. Avoid last-minute high-fee bank transfers.

8. Watch for Hidden Fees

Banks may charge receiver fees or inflate the FX rate. Use specialists that are transparent and built for international education.

⸻

💡 Pro Tip:

If you’re studying in Japan, Canada, Australia, the UK, or Europe — check out our dedicated Country FX Guides for local banking and money tips.

For paying your tuition fees, you may require a specific amount for each payment and benefit from a fixed foreign currency amount regular payment that removes the exchange rate risk.

More tips:

Travel Documentation - Passports/Visas

Make sure you have a passport that is valid, ideally, for the duration of your studies overseas so that you can avoid having to renew from a foreign country and paying any overseas surcharges. Depending on the time of year, passports can take weeks to process so if you don't have one, best get your application in as soon as you have your place confirmed.

A visa may also be required for your study overseas and this will depend on which country you are heading to. Check your study destination's embassy website in your home country for guidance on Student Visas.

Book your plane ticket

Book your ticket as soon as you know your dates. Try to time your flights for quieter days and times as this usually presents cheaper fare availability. It's quite simple to do this, you can use a price comparison site like kayak.com.au, or skyscanner.net and set it so that you can see all the available fares in the month you want to travel. For long-haul flights it may be worth investing in a call to a specialist travel agent who knows how to make the best of special offers.

Apply for a Scholarship

At the time of writing, the Australian Government is investing over $300 million each year in international scholarships which, at any time, support around 5000 international students, researchers and professionals to study in Australia. You can find quite a comprehensive list of scholarship information at www.australiaawards.gov.au/.

There is also an abundance of scholarships funded by many private businesses with an interest in providing support, usually in the form of financial assistance towards the tuition fees and living expenses, or internships with the business, for promising individuals.

Open a local bank account

Open a bank account in the destination country before you arrive wherever possible. In Australia, many banks allow accounts to be opened online ahead of when you step foot into the country e.g. CBA's Everyday Account with Student Options. Doing this enables you to make your international money transfer ahead of your arrival and also enable you to access local currency once you've verified your identity in a branch. Doing this also gives you a chance to familiarise yourself with the chosen financial institution and do some armchair navigating to branches close to your study base.

Get your local currency sorted

Once you have set up a local bank account, you're ready to transfer some funds across. Having your financials sorted before you arrive is a fantastic way to help you settle in quicker and more cheaply as using an ATM to withdraw from your home bank account may cost you dearly in fees and, typically, sub-optimal exchange rates.

Check if you need Health Insurance

If you need to visit a doctor or stay in hospital while you are overseas you could find yourself responsible for the full cost of any treatment, which can be very expensive. Students in Australia who hold a temporary student visa may be required, as a visa condition, to take out Overseas Student Health Cover (OSHC). Check on your destination government's website.

Disclaimer: Please note any provider recommendations, currency forecasts or any opinions of our authors should not be taken as a reference to buy or sell any financial product.